I’m starting to think about my 2011 goals, and as I was reading through some of my favorite blogs, I found this interesting list from Gen Y Wealth of 20 Financial Milestones for your 20s.

I found the list after one of my favorite bloggers, meinmillions, posted the list and her answers. Call me a sucker (like those people on Facebook and Myspace who would spend hours answering stupid questions about themselves) but I took the bait.

Let’s see if, at 25 years old, I’ve met any of these milestones I’m supposed to achieve before I’m 30.

#1 – Finance a dream vacation…in cash

Went to Europe with my signing bonus from work three summers ago. I’ll need to write a whole post on this thing because it was phenomenal. This was the birth of FAT KEVIN!

#2 – Pay off your student loans

I disagree with this one. Why would I pay off loans at 2.43% where the interest is tax deductible when I can take that money and invest it for a 10%+ gain? You might say that’s risky, but I’ll take a little chance for an 8% increase. That’s what being young and aggressive is all about!

#3 – Automate paying your credit card bill in full

I automate my credit card bill and all of my other bills. The only check I write every month is for rent. EXTRA CREDIT!

#4 – Get rid of all bad debt

What’s the definition of bad debt? I think the worst debt is probably money owed to a bookie with ties to the mob, but I bet he’s talking about high interest debt here. Student loans are good debt as far as I’m concerned, so I’m good here. I haven’t had any bad debt since I sold my last car.

#5 – Build an adequate emergency fund

Roth IRA + Checking + Investment Accounts would cover me for at least six months if needed to pull it out. Here’s to hoping I don’t need to touch that stuff.

#6 – Make your first, and last, investment mistake

– I was up over 150% on some C options and didn’t sell. Ended up getting about a 5% gain.

– I’m currently down 80% on some GE options and will probably take a loss here.

– I invested $200 in Washington Mutual right before they went bankrupt.

– I sold a bunch of CBS at about $13 earlier this year. It’s around $18 today.

– I sold Netflix at about $130 and it’s at about $190 now.

I could go on. No one is perfect. I will continue to make mistakes, and I will also continue to make lots of money. If you have a goal to never make an investment mistake, then you better be really happy with 0-3% interest. Nobody buys at the bottom and sells at the top every time. I’ll calling “stupid” on this one.

#7 – Develop a statement of cash flows

I know exactly what comes in and goes out. It’s called a budget. I don’t know what this statement of cash flows is, but I’m counting my budget for this one.

#8 & 9 Max out a Roth & Contribute to your 401(k)

Roth is maxed out, 401k contributions are in up to my company match, AND maxed out my HSA. MORE EXTRA CREDIT!

#10 – Get a degree or certification that increases your earning power

B.S. in Electrical Engineering from Washington University in St. Louis FTW! (that means “for the win” for you old people)

#11 – Take a career risk

I broke into a very important man’s office and put pictures of myself all over and basically took over his office. Risky? You betcha! I actually take career risks pretty frequently. I’ll write a full post on one of my most substantial career risks soon.

#12 – Negotiate something

The street vendor in Spain wanted 75 Euros for his painting. I bought it for trienta Euros. (That’s Spanish for 30).

#13 – Earn your first side grand

I’m negative $2,213.47 on this blog so far, so this appears to be an EPIC FAIL!

#14 – Start a sub-savings account for an upcoming financial goal

I don’t agree with this one either. Savings accounts have too low interest for me. If I were going to save for anything, it’d probably be a house, and I’d use at least CDs and probably dividend stocks to increase my return rate.

#15 – Set a target retirement date

My 70th birthday. Done. 70 isn’t old anyway.

#16 – Monitor your credit

I monitor my expenses to the penny every month, and get my free credit report once a year. That’s good enough for me.

#17 – Say no to a financial salesman

I say no every time I call a credit card company and they ask me to buy an add-on. I yearn for the automated system so I can hang up and not feel bad.

#18 – Give just enough to make it hurt

I will be donating over $500 a month next year. It will hurt quite a bit, but it hurts so good! This is the execution of my plan to combine two years of non-profit donations into one for tax benefits.

Two Milestones for the Over Achiever

#19 – Invest $1 for every $1 you spend

No way. I invested well over $10,000 this year when you combine everything, and that’s nowhere near what I spend (rent alone is $829 a month). This might be a good and worthy goal for some people, but I don’t like it and would never intentionally try to reach it.

#20 – Start a 529 College Savings Plan

I started one years ago for my niece. Instead of presents for her birthday and Christmas, she gets money in this account. I may not be the cool uncle now, but I’ll be her favorite when she’s old enough to realize how awesome the 529 is (and conveniently also old enough to babysit my future children).

Grand Total

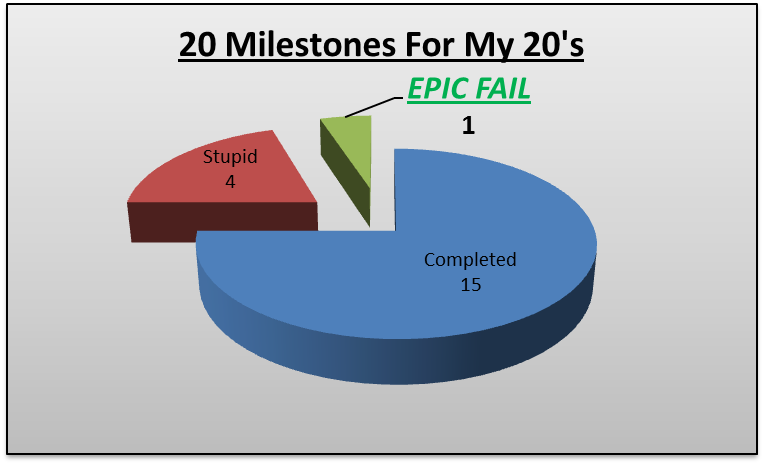

Of the 20 Goals, here are my stats:

15 – Completed

4 – I disagree with these goals and have no intention of reaching them

1 – EPIC FAIL

If I don’t make $1,000 on this website in the next 4.5 years, I am truly the biggest failure in the history of personal finance blogging. That’s a good goal for 2011. To make at least $1,000 from my blog (not necessary profit, but just bring in $1,000 in revenue).

How do you stack up to these 16 Good / 4 Bad milestones?

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Being nearly half a century ahead of you I have entirely different goals. Looks like you are on the right track and I’m guessing you are unusual for your age/generation.

Keep up the good work!

Darla

Thanks Darla. I can’t imagine how different your goals must be.

Very good list Kevin! I’ll comment on #6. So important one makes investing mistakes early in life rather than later. I’m glad I saw one of the greatest bull and bear markets early in life!

The money I lost is the ‘tuition’ for learning the ropes!

Luckily a lot of my failures are times where I made less than I could have instead of losing my own money. I’m still learning though.

Aww… one of your favorite bloggers! You’re too sweet! 🙂

And it seems like you’re doing pretty well for yourself!

Thank you for being an awesome blogger.

I’ll write up my own post (linking back of course) to cover where I end up, but I just wanted to ask what you’ve spent more than $2000 in blogging? This is not in a bad tone at all – I’m just curious.

I paid $125 to have my blog transferred from Blogger to WordPress, put in another $100-$150 on technical help, and another $100 or less on headers and stuff like that. I’ve also sunk in $250 on hosting for the next 3 years and domain names for the next 5 years. So, I’ve spent around $600. I kind of want to know if I’m missing something big, lol.

Great question. You’re missing videos. Most of my expense is video equipment. I’ll outline all the expenses in a post soon though.

Ahhhh, that makes sense. 🙂 I stink on camera, so there’s some savings for me right there, lol. Thanks!

Ok, I’m in my very late 30’s, but the 20’s don’t seem like THAT long ago for me. So, I can relate on some level as I had goals during my 20’s as well. Seems like you’re doing really well, and actually – I really like the Europe trip comment. I did that just as I closed out my 20’s going for a few weeks, and it was fantastic. Wasn’t all cash, as it took my 2 months to pay. It was an exception to my immediate payment, zero borrowing policy….but worth it. Gotta do that when younger and you have the time. Not as much time now:)

That trip was incredible. I saw some great things and made some great friends. It was definitely worth whatever I paid for it. (A lot)

I always have thought of an e-fund as being outside of investments. It’s probably a personal choice, but now I’m curious if investments count, I guess, according to you and/or financial experts (Suze Orman was the one who encouraged me to start one in the first place)? This may be revolutionary and change my saving habits for the next year!

The way I see it, if you can access the money within one or two days without paying penalties, it counts as an emergency fund. Only Roth IRA contributions count but that’s the majority of my Roth anyway.

When you say ‘do investments count towards e-fund?’, I have to say ‘what kind of investments?’

I think it goes beyond whether you can simply access your money within 1 or 2 days. It’s really important to understand the risk level that is part of your emergency fund and whether you are willing to take a loss on it in case of an emergency.

Even a savings account is a form of investment and carries some level of risk (Cash is an investment as well for that matter). Therefore the question for your emergency fund should not be ‘do investments count towards e-fund?’, but instead ‘what level of risk am i comfortable with in my e-fund’ and make sure you account for that risk in your 6 months calculation.

I have another year and a few months to go before I need to check over this list… I did the vacation thing though – used all the money from my internship a couple years ago to go to Italy for a couple of weeks. Awesome experience.

I wish my student loans were 2.5%… they’re mostly 6.8%. I do try to aim my payments at the highest interest ones first to bring the average down though. 6.8% is just low enough that I have a good chance of earning more than that in the market (ie, only make minimum payments now.) But it’s high enough that I’m not really comfortable with it.

Yeah, the ones with variable interest rates are at 2.43% I do have some fixed at 6% and 6.8%. When I do decide to pay some off, I’ll obviously pay those off first. However, I’m not gonna touch the ones with low interest until variable rates go up again.

just wanted to let you know that i’m reading your blog!

Id like more folks to become full-time bloggers! That would be a great career risk!

In regards to #13, it’s good to know I’m not alone 🙂

Excellent write up!

Hahaha! Just had to leave a followup since this my first comment – that’s a pretty awesome ‘first comment setup’ you have!

I’m just here to entertain. 🙂

I love this. 🙂

Great negotiation skills in Spain. I think that lots of people get taken in Europe not knowing that they area supposed to haggle. 70 is a perfect retirement age. I plan on working until I drop dead myself.

When it comes to paying off debt, the question is if you have the same amount of money that you are paying off available to invest. If you do not have the same amount of money available to invest, you might be better off paying your student loan, because dollar wise you might be making more dollars than the little you are investing. Then you can use the freed money to invest at higher amounts.

Plus the benefit of being out of debt, which means if you lose your job, you have no monthly payments. I stick to being out of debt. I paid off my student loans within the first two years, and the extra income from not paying interest was worth it. And now I have had Enough money to deal with life.

And there is no such hung as good debt other than owning a house, and even that has proven to be marginal.

Great post for conversation.