I paid off $33,850 of student loan debt in just over four years. Here’s Part 1 of how I did it.

I graduated from college in 2008 with $33,850 in debt. Most of that debt was in the form of Stafford or Perkins loans that were no higher than 5% interest.

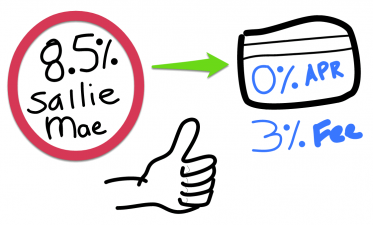

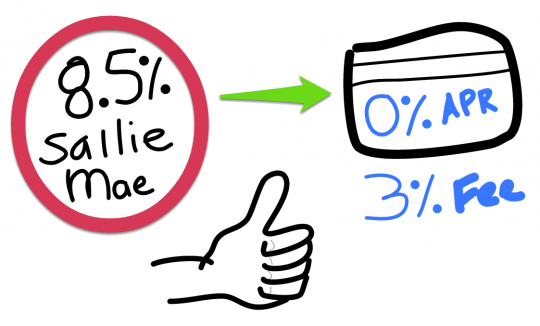

However, I had one Tuition Answer loan from Sallie Mae at an astronomical 8.5% interest rate. I knew I had to pay that sucker off as soon as possible!

The original loan disbursement in Fall 2007 was $5,225, and the balance had grown to $5,729.53 by November of 2008. I’d be damned if I was going to let another $400 of interest get added onto that loan! I needed to lower the interest rate somehow and get it paid off!

I didn’t have a lot of cash in my bank account, but I did have a good amount of income from my job. I figured that I could spend at least $500 a month to aggressively pay down this loan and get rid of it within a year. Now I just needed to figure out how to get out from under that 8.5% interest rate.

Enter a balance transfer credit card.

Use a Balance Transfer to Reduce Interest Rates

I had a 12 month, 0% APR balance transfer offer on a credit card, which included a 3% balance transfer fee. A 3% fee on $5,729.33 was $171.89, and I knew that I could get the full balance paid off before the 0% APR ended and I would save money overall.

With a 12 month promotional APR, that meant I was paying about $500 a month on that one student loan, in addition to the roughly $300 a month I was paying for the rest of my student loans.

So how did I manage $800 a month in student loan payments my first year out of college? I was living with roommates, which meant my rent was only $475 a month and utilities were split 3 ways.

Lesson 1: High interest debt sucks. If you have high interest debt, consider a credit card like the Discover® More Card – 18 Month Promotional Balance Transfer, which gives you 18 months of 0% APR with a 3% balance transfer fee, or essentially a 2% APR for the next 18 months.

Lesson 2: Just because you’re an “adult” when you graduate from school doesn’t mean you should pay “adult” bills. Live like a kid, get some roommates, and save a bunch of money.

Student Loan Payoff: Stage One Complete

The first step in paying off my student loans was to aggressively get rid of the high interest debt. I did it within a year. That brought me to the next phase of paying off my student loans, which I’ll talk about tomorrow.

Readers: Have you ever used a balance transfer to reduce interest rates on high interest debt?

Carnival Links

Carnival of MoneyPros at Finance Product Reviews

Carnival of Retirement at Simple Finance Blog

Totally Money Carnival at Financial Success for Young Adults

Yakezie Carnival at Free Ticket to Japan

Fin. Carn. for Young Adults at 20s Finances

Wealth Artisan’s FinCarn at Wealth Artison

Carnival of Financial Planning at Cult of Money

Festival of Frugality at See Debt Run

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Things may have changed, but I haven’t found a way to pay off my student loans using a CC. Which I would love to do and earn some frequent flyer miles.

Did you use one of those “checks” they send you?

I say this because it makes no sense for Discover to take your secured loan and turn it into an unsecured loan where you could default and declare bankruptcy (not that you would or I would suggestion someone should).

Get a balance transfer with one of those check. Write the check to yourself. Use the money in your bank account to pay the loan.

Yes, they are giving you an unsecured loan for you to pay off a secured loan, but they don’t know what you’re doing with the money. They just want to lend it to you because they deem you a good credit risk.

When I got out of college I had an abysmal credit score. I didn’t do anything to build credit back then though. How was your credit when you left college? Any college students out there looking to build credit, look into a secured credit card from your local credit union or bank. They are wonderful for building credit. My point is though you would at least need a credit history to get something like this, right?

Tremendous things here. I’m very glad to peer your article. Thank you a lot and I am looking forward to touch you. Will you kindly drop me a e-mail?