There are many reasons why people transfer money. People transfer money for the following reasons:

- Cross border trade (small scale or large scale).

- Payments of school fees for children or wards schooling abroad.

- In Africa, remittances from those working abroad to help impoverished families back home is a major source of money flows to various countries.

- Lately, the advent of cross-border freelance work has necessitated the use of money transfers as a means of paying for work done.

Traditionally, money transfers had to be performed via bank wires. This was a slow and tedious method of transferring money, with the need to fill a lot of paperwork as well as slow transit times which were elongated by weekends and public holidays. Companies like Moneygram and Western Union came on board in the 1980s to provide a faster means of wiring money across borders. These methods were also fraught with issues, chief of which was fraudulent withdrawals at the receiving points.

The need to be able to perform online transactions within the shortest possible time is what has given rise to the use of prepaid cards and safe money transfer alternatives, no matter where you are on the globe.

One method of transferring money that stands out is the use of a physical gold bullion account which is linked to a prepaid cards to make purchases. A gold-denominated prepaid card is a debit card which is tied to vaulted gold savings in a card account. In other words, the user must purchase real investment gold with cash, and this serves as the account balance that can be redeemed to the prepaid card to a.) Make purchases online and offline and b.) Send gold to a family member or friend anywhere in the world.

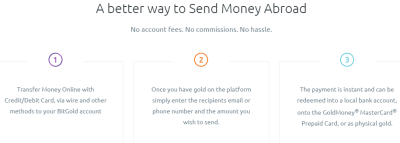

How Gold-Based Money Transfer Works

The process of performing a money transfer with your gold account has been made so easy that anyone can do it and indeed, get started in simple steps.

- The process commences by first filling a sign-up form. One of such cards is the GoldMoney® Prepaid MasterCard®, offered by BitGold. Two cards are usually ordered; one of the sender and one for the receiver. The cards work in more than 220 countries on ATMs, POS terminals and online shopping carts.

- The next step is to purchase some gold with cash using a wire transfer, credit card, bitcoin, ACH or a debit card. So you can calculate the amount of money you want to send using the exchange calculator on the provider’s website.

- When the transfer is made, the receiver can use the card to pull out the physical cash equivalent in the local currency.

The prepaid cards can also be at retail point-of-sale (POS) terminals and on online merchant sites.

Benefits of a Gold Prepaid Card

Using a prepaid card denominated in gold to perform cross-border transfers comes with huge benefits. Some of these are listed as follows:

- Using gold-denominated prepaid cards to perform transfers helps the user to save on transaction fees as it is usually cheaper.

- Use of a gold-denominated prepaid card for money transfers is safe, secure and instant. A greater percentage of remittances made from one country to another are usually done as a result emergency situations. For instance, an African worker in the US may need to send money for the treatment of a parent who may already be in hospital. Such a situation cannot endure the 7-working day waiting period for conventional wire transfers. Using a gold prepaid card solves the problem as the money transfer is available for immediate use by the receiver.

- If the sender wants to remit money on a monthly basis, it is possible to use a standing order to setup money transfers from a gold bullion card.

- Storing money on a physical gold-backed account could also protect against steep exchange rate fluctuations while presenting a safe way to preserve your money’s value in the long run. Long term, transferring money in gold benefits receivers as the value of money that they receive is preserved years down the road. Gold has risen 300% against the US Dollar in the last 15 years.

Sending money with gold bullion is cheaper than conventional methods of transfer. Fees do not usually exceed a flat rate of 2% per transaction.

Conclusion

Save on money transfers by using a gold-backed account. It is cheap and safe to use, and has a wide geographical reach since the MasterCard brand is available in more than 220 countries. The ability to receive payments in physical gold also presents a huge advantage to the receiver as he/she has the option to simple save in gold for a rainy day or spend the gold at the grocery store or to pay the bills. The best part is that these transactions can be performed from a smartphone.

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.