BREAKING NEWS!!!!

I figured out the secret to paying off student loans! Are you ready? I can break it down into three easy steps:

- Save up enough money to pay off the loan

- Write a check for the pay-off amount of the loan

- Send that check to your student loan company

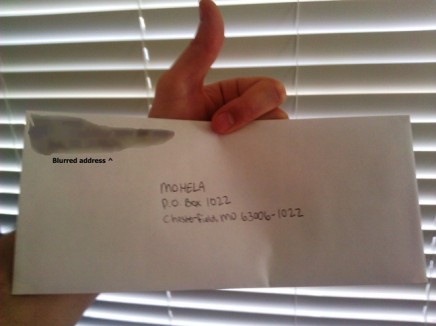

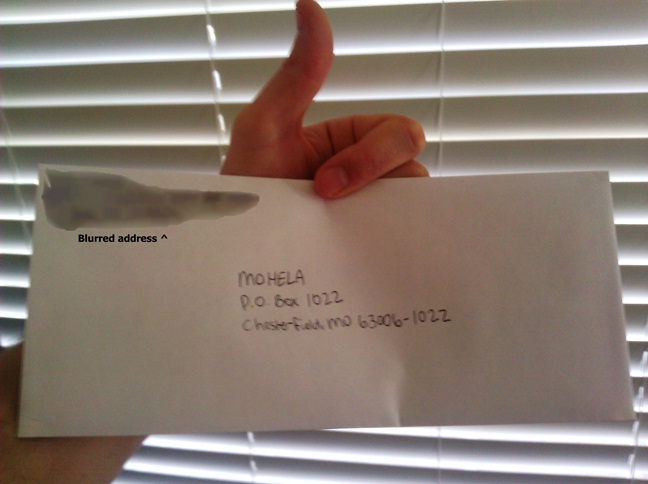

Okay, so it’s not really breaking news. It really is just that simple! Check out the letter I put in the mail last week!

Inside that envelope is a check for the amount of $3,363.15. It paid off one of my student loans, leaving me with just six more student loans at a combined debt of $10,878.51.

I Saved $403.25 Paying My Loan Early

According to my calculations, if I had made minimum payments on that loan for the next six years then I would have paid $403.25 in interest (assuming the 3.8% variable interest rate stayed flat) over that time period. I just spent $3,363.15 to save $403.25 for a 12% total return on my investment.

Sure, if I wanted to be a little more risky I could have taken that $3,363.15 and invested it. I’ve recommended that before, and there’s a very real chance you could make more money through the investment. It really just depends on your priorities.

If your priority is to increase your net worth as much as possible and assume any risk it takes to get there, then by all means invest your money.

But if your goals are to increase your cash flow by eliminating monthly payments, get a guaranteed return on your investment by avoiding future interest payments, and get rid of a loan that cannot be discharged via bankruptcy, then paying off student loans is the right way to go.

Don’t Pay Loans Too Early

You might be wondering why I paid off my loan in one big chunk instead of paying it off over time. I certainly would have saved more money on interest if I had made larger monthly payments.

But what if I paid so much that I didn’t have enough money to meet my monthly obligations? Then I would have had to borrow money to pay my day to day bills. Let’s pretend I put extra expenses on a credit card at 15%. That would mean I aggressively paid off a loan at 3.8%, but then needed a 15% loan to pay my bills. That’s not smart.

I know it’s exciting to pay off loans, but make sure you don’t do it too soon. That’s why I wait until I have enough money to pay a whole loan and not worry about whether or not I can make my rent payment.

Carnivals Last Week

Yakezie Carnival at Prairie Eco Thrifter

Carnival of Financial Camaraderie at My University Money

Totally Money at Family Money Values

Festival of Frugality at The Frugal Toad

Carnival of Wealth at Control Your Cash

Carnival of Financial Planning at Skilled Investor Blog

Carnival of Retirement at Retire By 40

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Way to go brotha. Get those loans gone, and get that cash flow, well FLOWING!!!

I wrote a massive check to pay off one of my student loans (the one that was at the retardedly high fixed 6.8% the Feds set). It was relieving to have that off my chest, but I was also sad to watch the money go.

But Congrats on being one step closer to be student loan free!

Great feeling. We have one loan that we paid off in full, but the second one is not a big deal to us right now, as it has a very low interest rate, pretty low monthly payment, and generally isn’t ‘in the way’. But I know when I get down around the balance that you had, I’ll probably just want to get it done and over with.

congrats! It’s always awesome to pay off chunks of debt.

Congratulation! It’ll be great once the other loan is paid off too. 🙂

Nice feeling huh? Congratulations!

Hold it, you’re bragging about 12%, but that’s not per year. That’ over 6 years.

So you realy got about 2% roi…um congratulations.

Oh and you lost an off the top tax deduction.

Most likely about 100 of that 400 would have been returned to you in taxes.

so you’re at about 9% return over 6 years. You did beat 5yr bonds, but not 7yr bonds. Great investment.

Some people make enough money that they aren’t eligible for the student loan deduction. But thanks for the condescending comment anyway.

I agree with Kevin here. Even if it were a 0% interest loan, if his goal was to increase cash flow, then a pay off is the way to go. It doesn’t really matter if its a good roi or not, because the extra cash flow may all the difference.

FYI: I am considering paying off my 0% loan and my 1.9% loan. Even though the money I would use to pay them off is earning more than 1.9% right now (my rational for taking the loans in the first place), some days I just feel like I want the extra cash flow each month.

The great thing about personal finance is that it is PERSONAL. You do what is best for you. If you decide that paying off your loan early is right for you, then it is the right thing to do.

And you can’t evaluate his return on his investment based on just paying the loan off. By going to school, he most likely increased his income. So considering he paid off a portion of his debt already sounds like it was a good investment to me.

Although it’s painful to write a large check (generally speaking), it was the right move. As soon as one of the Thousandaire videos gets exposure, you’ll get to write a check for the whole deal.

Congrats on paying off one of the loans! Paying off debt is simple in theory but can be difficult in reality.

I hate to break it to you but that payment isn’t going to make it. Next time put a stamp on that thing when you send it in!

Congrats! That is a big accomplishment. I was almost done with loans from my undergrad and grad school then decided to go for my Ph.D. I guess loans will be in my future for awhile now!

Great job, keep paying that debt down!

3.8%?! How are you able to find such low-interest student loans? Most of my plans are fixed at 6.8%