So I couldn’t get to a brand new post tonight, so it’s time once again to reach back into the archives and pull forward a post from months ago that most people haven’t seen yet.

This one is particularly relevant right now because our government is in danger of reaching our debt limit and defaulting on our loans. We need a long term, sustainable solution to solving our debt problem, and I have one idea right here. Enjoy, and I’ll be back with my Race to $1 Million update tomorrow.

——————————–

Yesterday the Federal Deficit Commission released their preliminary report on how they propose to tackle our outrageous federal deficit and debt. You can read all of their suggestions here, but the one I want to focus on is how they intend to save money on Social Security. For those that don’t know, Social Security is a federal program that pays people a monthly stipend once they reach a retirement age, depending on how much they paid in FICA taxes while they were working.

The retirement age is already increasing from 65 to 67. It will increase gradually until everyone born in 1960 or later gets full Social Security benefits at age 67, or in 2027.

The plan proposed by the Deficit Commission is to increase the retirement age from 67 to 68 by 2050, and to 69 by 2075.

Call me crazy, but I think we can give them even better.

Make it 70 by 2050!

I know what you’re thinking; “Why the heck would you want to raise the age even higher? Don’t you want to retire as soon as possible?” Great questions.

“Why do you want to raise your own retirement age?”

I have two simple answers to this question.

1. I love my country and want to do my part to help fix the deficit.

2. I believe it is the right thing to do.

The first reason is simple; I want to do what is best for America because I want my country to prosper. Obviously delaying the payment of benefits will help fix the deficit, so if it makes sense then I want to do it.

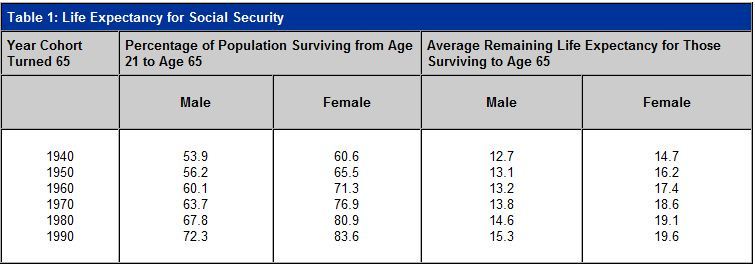

To understand why I believe it is the right thing to do, we need a little history lesson. Social Security was established in 1935 by Franklin Delano Roosevelt with a full retirement age of 65. According to government information, about 53.9% (male) or 60.6% (female) of the adult population in the 1940’s would live to 65 years old, and those people were living an average of 12.7 (male) or 14.7 (female) years past 65 years old.

Now let’s fast forward 50 years. In 1990, the percentage of the adult population living to age 65 increased to 72.3% (male) or 83.6% (female) and those people were living an average of 15.3 (male) or 19.6 (female) years past 65. That means as of 1990 we had millions more people on Social Security than in 1940 and they were living (and receiving benefits) three to five years longer.

You can’t add millions more people to Social Security and have them receive benefits longer without putting a huge strain on the system. To make matters worse for Social Security (but better for human beings), this study shows that people are not only living longer, but are also remaining in good health until a more advanced age.

If we are expecting to live a decade longer than our parents or grandparents in good health, then why should we expect to retire at the same age?

Social Security was designed to provide income to Americans who became too old and, in many cases, physically incapable of handling the demands of a job in the 1940s; a time when most jobs were much more labor intensive than they are today. If we were to alter Social Security today to accomplish the same goal it set out to accomplish in the 1940’s, I truly believe the retirement age would be 70 or higher based on today’s life expectancy and medical advances.

Maybe you still aren’t convinced. Maybe to you, 70 sounds like an old guy in a wheelchair pissing in a diaper and talking about the weather on his front porch. If that’s how you feel, let me introduce you to some 70 year olds (with pictures as recent as I could find):

I give you Ann Margaret, Al Pacino, Chuck Norris, and James Caan. All 70 years old in 2010. Do they look OLD to you?

If these guys are looking this good at 70 in 2010, I can’t even imagine how young I’ll look and feel after 40 more years of medical advancements. I don’t believe anyone in good conscience could suggest that, in 2050, 70 will be too old to work. If you take care of yourself and your body, you will be healthy and active well past 70 years old.

“Don’t you want to retire as soon as possible?”

I find my work quite fulfilling today, but I’m sure I’ll look forward to retiring at the end of my career. I’m almost certain I will want to retire before I’m 70 years old; I just don’t believe it is the government’s responsibility to provide me with retirement income until I’m 70 or older.

From what I understand, our senators and representatives view “raising the retirement age” as political suicide. I may only be one voice, but I’m going to tell my congressmen that we should raise the retirement age because, very simply, it is the right thing to do.

Who’s with me?!

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Not an American, don’t really care 😛

But holy F, is that Al Pacino! And he’s 70????

Dang.

Yep. All those are recent pictures. They may be 69, but I tried to find all pictures of these people at 70.

Seriously, 70 is not old.

I totally agree with you if we are keeping it around and have it serve the same purpose as it does today. I think the majority of people are simply lazier nowadays than they used to be so they want to magically get money without working for it.

I can’t believe that some of them are 70 now. I knew they’ve been around for awhile but had no idea.

Yep. I know these famous people aren’t your average 70 year old, but it just goes to show that 70 really isn’t that old.

Yeah, if you have the $$$$$ to pay for surgery to keep you looking young. All those miracle medical advancement will cost so much money, only the rich will be able to afford it. You’re starting young though so you probably will be ok. 😉

BTW, I suggest you revisit this post in 10 years and you’ll see how age can mess you up.

Like I said, I’m sure I’ll want to retire early, I just don’t think it is the government’s responsibility to give me what I want.

OK, fair enough. Then, I also don’t think it’s the government’s RIGHT to take away 6.2% of my income – income that the government promised to return to me at retirement.

But they will return it. He’s just saying we should have to wait longer.

Great post, very persuasive.

The idea that people must work longer to support a bloated government is a dangerous idea. This harms the economy by reducing the number of jobs available to younger people. Our economy is not short on workers it’s short on jobs. Common medical problems among the elderly such as arthritis, dementia, and diabetes would endanger the public. Would you want to ride in a bus with driver having dementia? It’s the wealthier elderly who are living longer.. Raising the retirement age cuts benefits for those who must retire earlier and often won’t live long anyway due to medical problems. Meanwhile, wealthier people with soft jobs work on.

I’m with ya! We do all work for this money as we have it taken out of our paychecks, but I’d gladly give up all of my benefits if I could just avoid that deduction ;).

I agree with you on that. I wish this law never existed and I could use that 6.2% to save for my own retirement. However, we have to work with the hand we’ve been dealt now.

I wrote about this subject too. And to think the French were pissed about retiring at 62? After they get an average of a MONTH of vacation each year whereas Americans average less than 40 hours? If I hear someone else call me a lazy American again…

I know! I meant to include something about the French but then I remembered “there’s no such thing as bad press”. Stupid French people.

(actually I really enjoy all of the French people I know. It’s just their politics I don’t agree with)

I’d love for them to bump up the age for more selfish reasons:

1) I’m saving for my own retirement and think others should do the same.

2) I might actually have a shot of getting some money from social security if they don’t run it into the ground in the next 43 years…being 27 and knowing that I’m contributing (ALOT) to a system that may not ever contribute to me is sad…

I agree with you there. I’d also much rather have something than get nothing at all. If we have to push it back for that to happen, then let’s do it!

I agree with you and, in fact I would be for doing it sooner. We should have raised these retirement ages decades ago. Unfortunately we failed to do what we should have done and the costs are greater every day we wait.

I do think it would be good if we can culturally adapt to moving into retirement in stages: going to part-time for years and then full retirement. this would allow society to benefit from more working years out of people and also allow people to take a bit more time off as they become less able to keep up the full pace of work life and approach retirement.

The age of 70 should be a minimum. Three things can save the budget:

Cut back on foreign spending, and military

Increase retirement age

Reform tax laws. Have a few brackets but flat taxes in each. No credits, deductions, or exemptions in favor of lower marginal rates.

Good suggestions. I agree that we need to cut spending and reform tax code. I’d love to see the Fair Tax implemented. If we move to a national sales tax system, we will essentially eliminate all the money we waste on the complicated IRS. Then we also get some money from illegal immigrants and tourists that we don’t get today.

Totally agree! I feel like there should be some sort of petition I can sign.

A grassroots effort might work, but I think it’s more important to contact your congressman. That would be the best way to make an immediate change in my opinion.

Doesn’t the US have one of the lowest life expectancy rates among the developed world? If anything, your retirement age should be lowered! 🙂

I love your posts, Kevin, and I don’t mean to pick on you. I just think it’s so funny that Americans tend to look at all other nations and think, “Wow, they do things differently — so wacky!” without realizing that most other developed nations do things in a similar way, and it’s the US that is a bit of a black sheep in terms of a lot of things. (Specifically talking about some of the comments made in here.)

Sincerely,

Canada

You’re damn right we do things a little differently. That’s why our GDP is bigger than the next four biggest economies in the world combined. 🙂

If you don’t want to work at the end of your life, it should be your own responsibility to ensure that happens. If the government has any obligation to give money to old people (which by itself is questionable), it should only be when they don’t have any other means to provide for themselves; not when they want to live a leisurely lifestyle.

But doesn’t the US have the largest population among developed nations? Of course your GDP is bigger than Canada’s: you’ve got ten times more people working at it! But you’ve also got more national debt than most (all?) developed nations, a broken social security system, a broken healthcare system, lower minimum wages, more crime, more poverty, etc. GDP is not the best measure of the wealth and stability of a country. Lots of other things to keep in mind. (and I mean this of all countries, not just to pick on the States. You can’t just pick one statistic that looks good and use it to decide how your country ranks wit others, you know what I mean?)

The US isn’t perfect, and GDP isn’t a perfect measurement of a country’s success, but it is a major one. And a lot of the “problems” you mentioned were merely opinion. If I had my way, I would obviously cut social security benefits and start them later, as well as repeal Obamacare and open up health care plans among the states. I would also lower or eliminate the minimum wage.

Our healthcare may be expensive, but we also have more medical breakthroughs than any other country in the world. We have the best doctors and researchers in the world, and that’s why we pay for it.

They seem like problems to you because we do things differently, but that doesn’t make them problems. 🙂

Oh, and p.s., isn’t 2050 the year YOU will turn 65? 😉

Of course I turn 65 in 2050. I’m not one of those idiots that wants the next generation to pay for things. I feel like my generation has a responsibility to fix it. We need to bite the bullet and lead by making a sacrifice.

My dad’s 70 (yeah, they were in their 40’s when I was born) and my mom turns 70 in a week from today. They have WAAAAY more energy than I do. We’ll go to a conference together, and by the end of the weekend, I’m exhausted and they’re still raring to go! They’re also super-active: this summer they’re flying to Russia “just because.”

Good blog Kevin. One additional thing to consider is that Social Security also covers disability (SSI and SSDI). As the retirement age ticks up, so too will the eligibility age for disability benefits for those that qualify or are working and not of age to begin collection Social Security as part of their retirement. Few people are fully factoring in disability as part of maintaining Social Security, but logically it is going to cost much more in the next decade.