I’ve always been a numbers guy.

I have bachelor’s degrees in Mathematics and Electrical Engineering.

Of the top of my head, I can tell you my exact 100 breaststroke time from each of my three years of competitive swimming (1:03.38, 1:01.21, and 1:00.15). I have my volleyball stats from my senior year of high school saved to my computer. When I golf I obsessively track my score, fairways hit, and putts, and then input that information into a spreadsheet.

I have an unhealthy obsession with numbers.

I’m no different when it comes to personal finance. In fact, you can see a lot of my numbers obsession first hand.

I’ve created The RC, which is a retirement calculator that helps me model my financial future. I whipped up Health Insurance Made Easy, which is a handy spreadsheet that helps me determine which health plan makes the most financial sense. I’m also a meticulous budgeter, reviewing every single transaction monthly and inputting it into my modified budget spreadsheet.

What if Clippit came back with a vengeance, pissed off that he’d been deleted, and told me to pick my favorite spreadsheet because he’s going to delete everything else? Well, I wouldn’t pick any of those spreadsheets I mentioned.

Nope, I’d pick my Net Worth Tracking spreadsheet.

Net Worth Tracking Spreadsheet

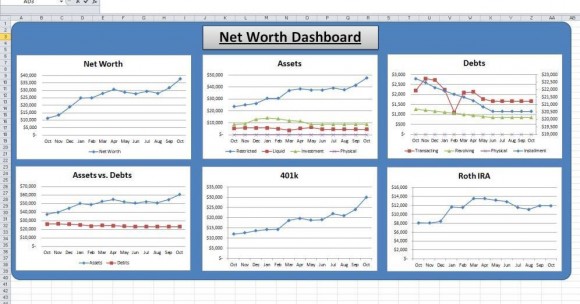

Once I calculated my net worth for the first time, I knew I was going to have to find a good way to track the information moving forward. Being the numbers geek that I am, I wanted to see a trend of where my assets were increasing, which debts were decreasing, and a comparison of my assets to debts over time. In addition, I wanted to quickly see the performance of my retirement accounts.

Here’s what I came up with. I call it my Net Worth Tracking spreadsheet (free download if you want to use it yourself).

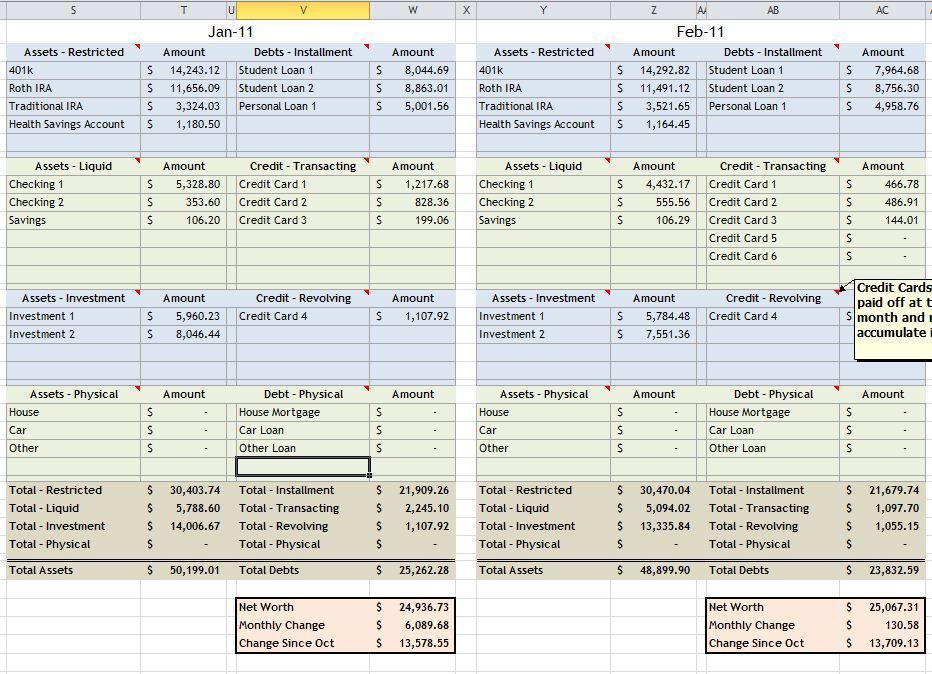

This baby splits up my assets into four categories:

- Restricted: Any assets that cost money to touch, like retirement accounts, CDs, and my HSA

- Liquid: Money I can turn into cash almost immediately, like checking and savings accounts

- Investments: Non-restricted investment accounts, like my brokerage account

- Physical: Things like homes and cars that have value if sold

I also split up my debts into four categories:

- Installment Debt: Student loans and personal loans. Does not include credit cards or loans tied to physical assets

- Credit Transacting: Credit cards that are paid off every month

- Credit Revolving: Credit cards that are not paid off every month and may accrue interest (unless it’s a 0% APR)

- Physical: A mortgage or car loan. Anything tied to a physical asset.

What Gets Measured Gets Improved

I used to work out at LA Fitness, and they would always have some guy interrupt the songs over the speakers with this message: “What gets measured gets improved, so sign up with a personal trainer to measure your weight and body fat!”

It’s kinda cheesy, but it’s so true. If you aren’t measuring something, you never really see the impact when you start falling behind. Sometimes you have a feel for if you are making progress, but unless you actually measure something, you’re never going to know how well you are doing, and how much room you have for improvement.

If you don’t track your net worth today, I strongly encourage you to download my Net Worth Tracking spreadsheet and start measuring your financial life. You’ll be amazed at how much more aware you will be of your spending and saving. And I can tell you from experience, it feels pretty dang awesome to see those numbers go up!

Feel free to download it straight from this link, or head over to my downloads page where you can get this spreadsheet, as well as all of my spreadsheets and MP3 versions of my songs. It’s all free, so just enjoy and tell your friends.

Spreadsheet Instructions

The sheet is pretty self explanatory, and there are instructions included inside the sheet. One important thing to note is that I have included a macro in this spreadsheet. This macro is used when you have 13 months of information in the spreadsheet. It deletes the first month, moves months 2-13 into spots 1-12, and opens up spot 13 for the next month. It’s very helpful once you hit a full year of information.

WARNING: Macros can include viruses, so only enable macros on spreadsheets that you trust. I promise I didn’t put anything bad in there (I wouldn’t even know how to), but if you don’t trust me, don’t enable the Macros when you open the sheet.

If you have any questions about how it works, suggested improvements, or just want to let me know if you like it, please leave a comment below!

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

I am moderately afraid right now. This is like the most ballin’ spreadsheet I’ve ever seen.

I just add up the amounts in all my accounts every month, and call it a day…

You have to get involved with this thing! It will change your life.

I’ve been looking for a tool to help me see what my net worth is. Now that you have supplied one, I am terrified to see how bad it is.

You can’t address your financial situation if you don’t know what the situation is. Don’t be scared! You can do it!

You are my new idol! That spreadsheet rocks! I can’t wait to plug my own numbers into it and see where I net out.

Good luck! It doesn’t matter as much where you start; it’s all about where you go from here!

Sweet!! I’m going to give this spreadsheet a try. I calculated my net worth the other day with an ultra-rudimentary spreadsheet — Column A: bank accounts / Roth IRA account / etc., and Column B: the amounts of each said account. But I like the idea of having a visual graph!

On another note — why oh why did you have to remind me of Clippit?? I’m had so many stand-offs with that stupid animated paper clip!

I still have nightmares about Clippit. He will never leave me.

Nice spreadsheet, Kevin. I shamelessly downloaded it already.

That’s what it’s there for. Hope you like it!

Looks like you’re a well organized man. This planner will really help my brother who’s so into statistics of expenses.

I hope he likes it. If he’s good with excel he can add more graphs and charts to give himself a more detailed view of what’s going on. That’s why I love excel; no limitations!

Do you plug the numbers in at the same time each month? My net worth is a lot higher right after I get paid than it is right before I get paid.

I always check my net worth in the first 1-3 days of the month. In months where there are 5 Fridays and I get three paychecks, well, it’s just gonna be a good month. 🙂

very nice spreadsheet. I have a spreadsheet to track my current net worth, but adding a graph would be cool.

Yeah, the graphs give a really nice snapshot. It’s hard to see trending if you don’t have the graphs.

DAng, Math and EE major?! Nerd alert man! lol

I check out my NW once a quarter for a couple minutes to make sure I’m on track. I donno why, but I’ve lost that addiction to check much.

Oh I’m definitely a nerd, there’s no question about it.

More power to you if you can manage your financial life without needs to track closely and watch the numbers. Congrats on having such a natural control of your finances. You’re the man, Sam!

It gets boring after a while Kevin as things get pretty predictable. I’ve got a pretty boring income stream.

It’s such a cheesy saying, but I always remember it and I think it’s so true as well!

Nice work Kevin. I’ve always used Quicken to track all of this info. With the later versions you can set up all sorts of custom fancy graphs and spreadsheets with the info in Quicken.

The nice thing about Quicken is I can download my transactions for banking and investing directly in the various accounts and then categorize them. Quicken makes it easy because it remembers that every time you get a transaction from Grandma’s Corner Store you want it to go under the category Groceries. You can change it on the fly but it makes it simple to download transactions and have them categorized in just a few minutes.

In addition, you can pay your bills directly from Quicken (assuming your banks cooperate and most do now). This allows you to schedule your bills being paid ontime as soon as you receive them so you don’t forget to pay that pesky electric bill and come home to melted ice cream.

As a result of having all my transactions up to date in all their categories I can see my net worth at a glance at any moment without any extra work. I can even click my mouse twice, update my stock quotes and know just how much I’m making (or in the case of the last couple of weeks – LOSING! Grrr).

Try it, for number geeks like us it feeds our addiction AND makes it easy cutting out duplicate work.

Engineers and mathies unite! I wrote an application to manage my finances because they got too tedious for Excel. There are some things that I still use Excel for: projections and budgeting (because of projections). My absolute favorite part about my net worth worksheet is that it projects over the next several years. Actually, I made it project monthly for the next 10 years and then added some rows for projecting until it calculates I will be a millionaire (around age 49 – ages away, darnit!)

My application does graphs for almost everything, but I also have some graphs in my Excel spreadsheet – namely for contributions versus value of my investments. I don’t have separate graphs for my Roth IRA or my 401(k) because I track all of my investments as a group.

One of my favorite features of my net worth worksheet is that it has columns for the month and rows for the category/subcategory, so I can very easily see the difference month-to-month. I “hide” the columns from January through November at year-end, so that you can easily compare to the end of the previous year. I started tracking my net worth in this spreadsheet after finishing university and it’s been amazing to see the upwards slope of that overall net worth (almost) every month!