As I’ve mentioned before, I love using credit cards for the rewards. The card I use for almost all my purchases is the American Express Blue Cash card. This card gives you 1% cash back on gas, groceries, and pharmacy spending, and 0.5% cash back on everything else until you spend a total of $6,500. Then, for the rest of the year (my “year” goes from March 2010 to February 2011), you get 5% cash back on gas, groceries, and pharmacy, and 1.25% back on everything else.

Well as of my last statement, I had spent $6,483.10 on the year. Essentially everything I purchase from now until February 2011 will earn me the higher cash back rates.

I told you a few days ago about my $1,000+ day at Men’s Warehouse. When that transaction hits my statement, AMEX is going to give me about $12.50 back.

Every gallon of gas that costs most people $3.00 is only going to cost me $2.75 thanks to my reward.

Now that I’ve broken this 5% barrier, I need to make the most out of my cash back opportunities. So far this year, my average monthly spend on groceries has been $129. My average on eating out has been $164.

If I make a point to eat out less and buy more groceries, I think I can increase the groceries spend to $159 (+$30) and decrease eating out to about $114 (-$50). This will not only save me $20 a month by eating out less, but any added grocery expense I incur will get 5% cash back.

And yes, I realize 5% of an extra $30 is only $1.50 a month, but it’s my credit card and I can be excited if I want to. I will be buying more groceries and eating out less for three reasons now:

- More Cash Back

- Less Overall Spending on Food

- Prevent Obesity

If I spend $159 on groceries each month over the next five months, I will have spent $795. When you take 5% of that, you get $39.75. I will basically earn as much cash back with $795 in spending on a single category as I did in seven months of all categories combined. This is seriously exciting!

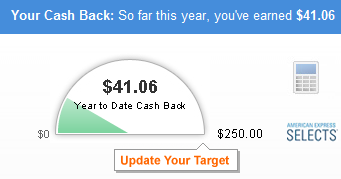

I have set a goal of $250 cash back on what I expect to be about $12,500 in annual spending. That would be an overall effective rate of 2% cash back. I think that’s pretty darn good, but I also wonder if there is a different card that would give someone with my spending habits a better reward.

One more thing to note about eating out was that I noticed a lot of restaurant gift cards at my local grocery store. I think I can buy the gift card at the grocery store and get the 5% reward, and then use it at the restaurant. To take this a step further, I can even buy a generic Mastercard or Visa gift card to get 5% cash back on just about anything I buy. I’ve looked at the terms and conditions, and here is the official text:

… Eligible Purchases do not include interest charges, fees, cash advances or other means of accessing your account, convenience checks, balance transfers, or the purchase of American Express® Travelers Cheques and American Express® Gift Cheques or other cash equivalents. We reserve the right to exclude charges that we determine are not made for personal, family or household purposes; with the good faith intention of consuming the item charged; or with the intent to avoid a per-transaction rebate threshold. Additional terms and conditions apply.

Based on the bolded text (especially the stuff in Green), it looks like AMEX has foiled my plan. It can’t hurt to give it a try though and see what they do with the charge. I’ll report back with the results of this in a later blog post.

Let me know if you have the same card and how it works for you, or if you have a different credit card with a better rewards program. My only loyalty is to the card that gives me the most benefits.

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

I agree with you Kevin. Credit Cards are the greatest invention ever.

If you don’t mind a little bit of effort, you can maximize you cash back returns by utilizing multiple cards. Here is my wallet:

– Citi PremierPass Elite for travel (1 point per mile flown)

– CitiForward Card for 5% cashback on dining

– Citi Diamond Preferred for 5 points per dollar on grocery/gas

– Fidelity AMEX for 2% on everything else

Sometimes a little bit of research can yield some great benefits. Several of these are introductory offers so you may have to rotate through cards (which means you get a free $100 dollars for signing up again)

-The Hoff

That’s incredible Hoff! No wonder you are beating me in our race to $1 million, you are getting 2-5% cash back on every dollar you spend. Thanks for sharing.