10 Items You Must Include In Your Marriage Emergency Kit

When we say “I do,” we often envision a life filled with harmony and shared dreams. However, every marriage faces its challenges and crises. Just as you’d pack an emergency kit with essentials for a natural disaster, it’s equally crucial to prepare a marriage emergency kit. This kit contains tools and resources to help you navigate the rough waters you and your spouse may encounter. Here are ten indispensable items to include in your marriage emergency kit, ensuring you’re prepared for any marital storm.

1. Communication Tools

Effective communication tops the list of any marriage emergency kit. This includes having regular check-ins and knowing the basics of conflict resolution. Equip yourselves with books and apps, or even enroll in workshops focusing on enhancing communication skills. Remember, it’s not just about talking; it’s about listening, understanding, and responding appropriately.

2. Shared Goals and Plans

A clear set of shared goals works like a compass in a storm. Whether it’s financial targets, family planning, or personal aspirations, these goals can guide you and keep you connected during times of disagreement. Sit down together at least once a year to review and adjust these goals. This ensures that both partners feel their needs and dreams are valued and pursued.

3. Couple’s Therapy Contact

Don’t wait for a crisis to find a therapist. Include contact information for a recommended couple’s therapist in your kit. Therapy is not just for solving problems but also for strengthening your relationship in good times, providing tools to handle future issues more effectively.

4. Stress Relief Strategies

Stress can strain even the strongest marriages. It’s crucial to have personal and joint stress relief strategies ready. This could be as simple as knowing each other’s signs of stress and having a plan to give space, or engaging in activities like yoga, meditation, or a shared hobby together. Keeping stress in check prevents it from overwhelming your relationship.

5. Financial Management Plan

Money issues are often at the heart of marital discord. Your marriage emergency kit should include a clear, agreed-upon financial management plan. Whether it’s a monthly budget, an annual review of finances, or plans for investments and savings, managing these aspects together can prevent many conflicts.

6. Intimacy Schedule

Physical and emotional intimacy can sometimes take a back seat during busy or difficult times. Maintaining intimacy is crucial, so consider including a ‘schedule’ or regular plans that help maintain your connection. This could involve date nights, weekend getaways, or simply daily moments of connection like a morning coffee together or a goodnight kiss.

7. Appreciation Reminders

It’s easy to take each other for granted. Keep a jar of notes in your kit, with each slip containing a reason you appreciate your partner. Whenever one of you feels underappreciated, take a note out of the jar. This can serve as a powerful reminder of your partner’s love and dedication.

8. Conflict Resolution Rules

Establish rules for fair fighting. This includes no name-calling, taking timeouts if needed, and always striving to understand before being understood. Additionally, agree to always address issues directly with each other rather than involving outside parties, which can complicate matters. Having clear rules can prevent damaging blow-ups and keep conflicts constructive.

9. Support Network Details

A robust support network is crucial for marital resilience. Include contact details for close friends, family members, or community groups that can offer support when needed. Also, consider identifying a couple you both respect who can provide mentorship or guidance during difficult times. Knowing you have a supportive community can alleviate the pressure during marital crises.

10. Memory Box

Sometimes, you need a reminder of why you fell in love. Keep a box with mementos from your relationship, like photos, love letters, or small gifts. During challenging times, going through this box together can reignite your love and remind you of the joys you’ve shared.

Prepare Your Marriage Emergency Kit Today!

Preparing a marriage emergency kit is not an admission that you expect things to go wrong; instead, it’s a proactive measure to strengthen your bond and ensure you can handle whatever life throws your way. With these ten essential items, your marriage has a better chance of not just surviving but thriving through the inevitable ups and downs. Start assembling your kit today, and approach your marital journey confidently and securely.

Read More:

8 Boomer “Complaints” That Are 100% Justified

Hidden Dangers: 10 Safety Measures to Take When Cleaning Your Home

Cults Gone Bad: 11 Groups That Started with Good Intentions

The concept of cults has long intrigued and disturbed society, often evoking images of secretive and manipulative organizations that exploit their members for nefarious purposes. However, not all cults begin with malicious intent. Some start with seemingly noble aspirations, only to spiral into dangerous territory as their leaders become increasingly authoritarian and manipulative. Here, we explore eleven groups that began with good intentions but ultimately devolved into destructive cults.

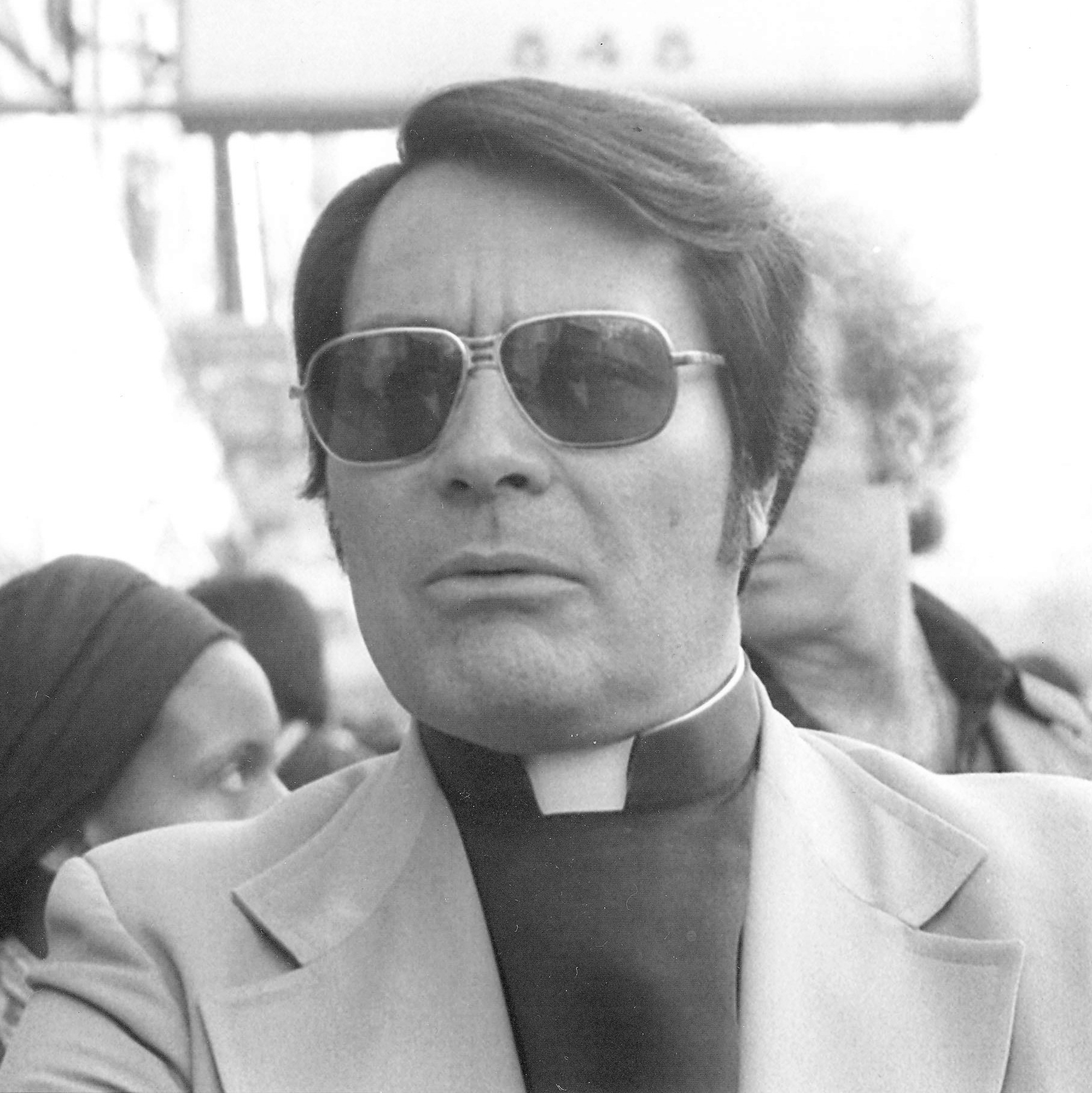

1. The People’s Temple

Founded by Jim Jones in the 1950s, the People’s Temple started as a progressive and racially integrated religious group focused on social justice and community service. However, as Jones’ control over the organization grew, so did his authoritarianism and paranoia. In 1978, the group infamously ended in tragedy with the mass murder-suicide in Jonestown, Guyana, where over 900 members drank cyanide-laced Flavor Aid at Jones’ command.

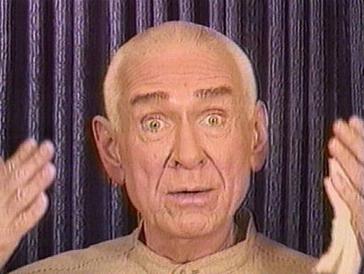

2. Heaven’s Gate

Heaven’s Gate, founded by Marshall Applewhite and Bonnie Nettles in the 1970s, began as a UFO religious cult centered around the belief that Earth was about to be “recycled” and that their souls could ascend to a higher level of existence by leaving their physical bodies behind. Despite their peaceful origins, the group’s strict adherence to Applewhite’s teachings led to the tragic mass suicide of 39 members in 1997, all hoping to hitch a ride on an approaching comet.

3. The Branch Davidians

The Branch Davidians, a splinter group from the Seventh-day Adventist Church, was led by David Koresh in the 1990s. Initially centered around biblical study and prophecy interpretation, the group’s compound in Waco, Texas, became the site of a deadly standoff with federal agents in 1993, resulting in the deaths of Koresh and 75 of his followers, including women and children.

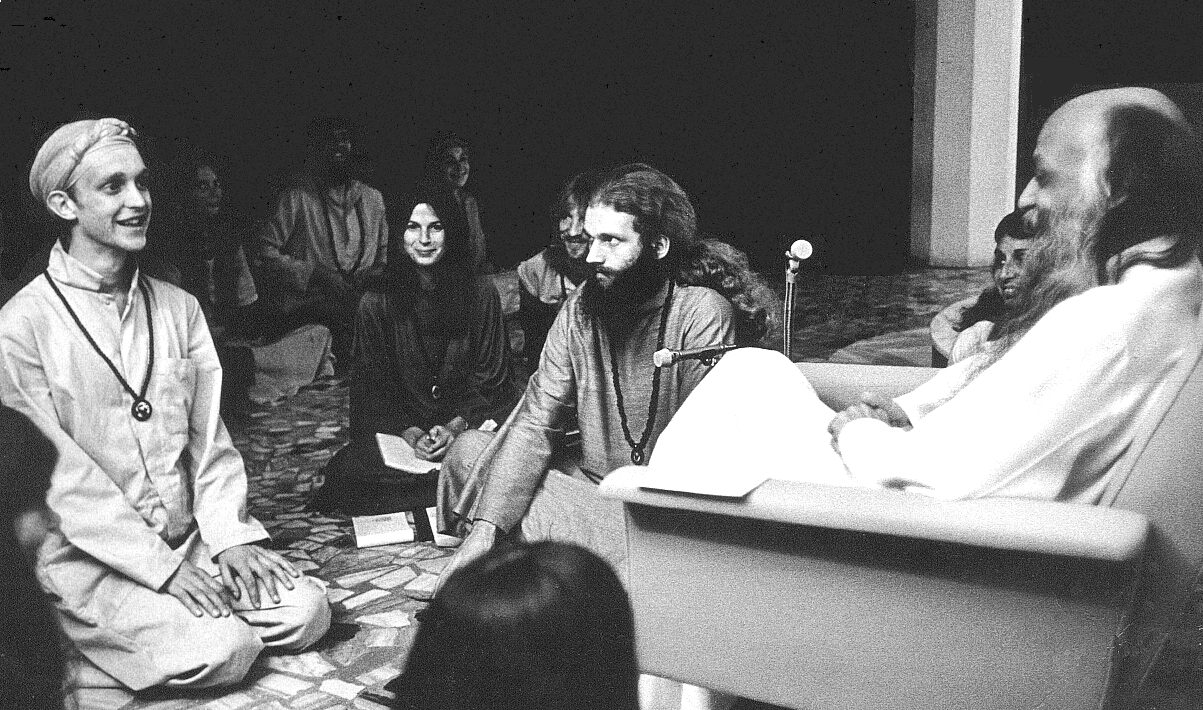

4. The Rajneesh Movement

Founded by Indian guru Bhagwan Shree Rajneesh (later known as Osho) in the 1970s, the Rajneesh Movement attracted thousands of followers with its teachings on meditation, spirituality, and free love. However, the movement’s utopian commune in Oregon, known as Rajneeshpuram, descended into chaos and criminality as Rajneesh and his inner circle engaged in illegal activities, including immigration fraud and bioterrorism.

5. NXIVM

NXIVM, founded by Keith Raniere in the late 1990s, marketed itself as a self-help organization focused on personal and professional development. However, behind closed doors, Raniere ran a secretive cult-like group that engaged in manipulation, coercion, and sexual exploitation. In 2019, Raniere was convicted of multiple charges, including racketeering, sex trafficking, and forced labor.

6. The Order of the Solar Temple

The Order of the Solar Temple, founded in the 1980s by Luc Jouret and Joseph Di Mambro, blended elements of Christianity, New Age spirituality, and apocalyptic prophecy. The group’s belief in an impending global transformation led to a series of mass suicides and murders in Switzerland, Canada, and France between 1994 and 1997, claiming the lives of over 70 members.

7. The Movement for the Restoration of the Ten Commandments of God

Founded in Uganda in the late 1980s by Joseph Kibweteere and Credonia Mwerinde, the Movement for the Restoration of the Ten Commandments of God espoused a blend of Catholicism and apocalyptic prophecy. Despite its initial focus on religious devotion and moral purity, the group ended in tragedy in 2000 when its leaders orchestrated a mass murder-suicide, resulting in the deaths of over 900 followers.

8. The Family International

Originally known as the Children of God, The Family International was founded by David Berg in the 1960s as a radical Christian group promoting communal living and evangelism. However, allegations of child abuse, sexual exploitation, and cult-like practices tarnished the group’s reputation over the years, leading to a series of rebrandings and internal reforms.

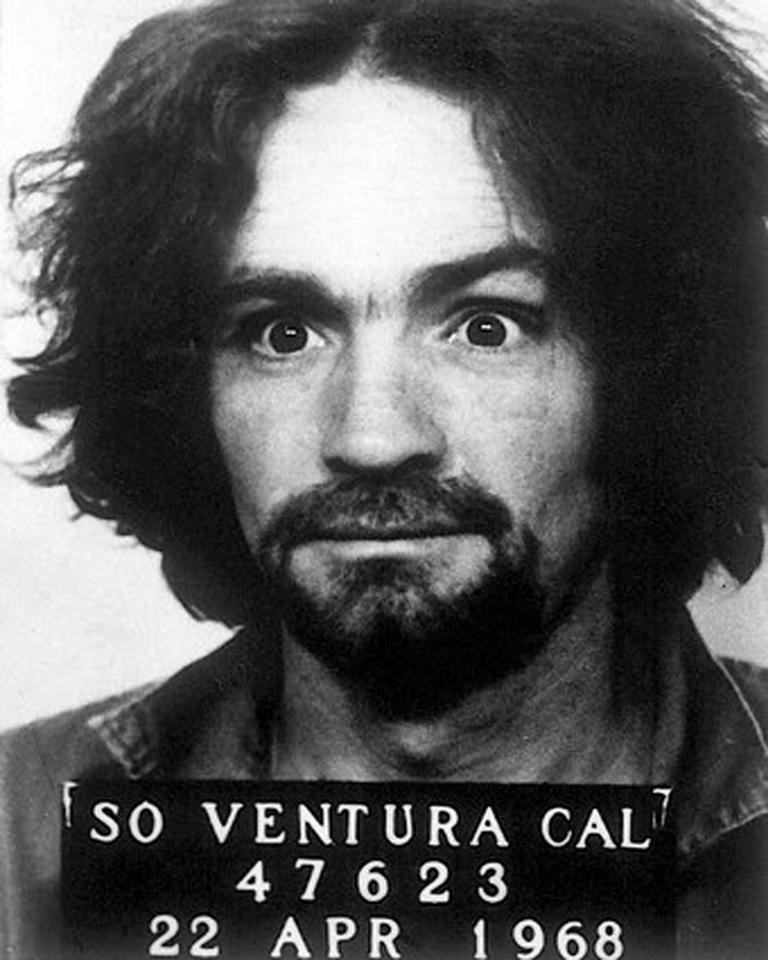

9. The Manson Family

Led by Charles Manson in the late 1960s, the Manson Family started as a commune-like group centered around Manson’s apocalyptic beliefs and charismatic leadership. However, Manson’s messianic delusions and violent rhetoric ultimately culminated in a string of murders, including the infamous Tate-LaBianca killings in 1969, which shocked the world and brought an end to the Summer of Love era.

10. The Love Has Won Cult

Founded by Amy Carlson in the early 2000s, the Love Has Won cult purported to spread messages of love and spiritual enlightenment. However, Carlson’s authoritarian rule and erratic behavior alienated many followers, and the group faced allegations of abuse and manipulation. Carlson’s death in 2021 sparked controversy and renewed scrutiny of the group’s practices.

11. The Tony Alamo Christian Ministries

Led by Tony Alamo, the Tony Alamo Christian Ministries began as a small evangelical group in the 1960s before evolving into a cult-like organization that promoted Alamo’s extreme beliefs on topics such as polygamy, child marriage, and conspiracy theories. Alamo’s legal troubles, including convictions for tax evasion and child abuse, exposed the dark underbelly of the organization and led to his imprisonment.

Sobering Reminders

In conclusion, these eleven groups serve as sobering reminders of the potential dangers of charismatic leadership, ideological extremism, and unchecked power within religious and spiritual organizations. While many cults may begin with seemingly good intentions, the consequences of their actions can be devastating and far-reaching. By examining the histories of these groups, we can gain insights into the warning signs of cult behavior and work towards preventing similar tragedies in the future.

Read More

Navigating Change: TPT’s Expertise in DB Scheme Consolidation

Jonathan Jackaman, Head of Business Development at TPT, discusses the options that are now open to you, irrespective of what stage you are in your long-term path, since DB pension schemes consolidation options may make it difficult to determine which option is appropriate for your strategy.

He stated, “Each consolidation option has particular advantages. As with other things, it all boils down to determining the best method for your scheme, sponsor, and members. In many circumstances, it may be advantageous to apply various consolidation methods as you proceed throughout your end-game trip.

For instance, transitioning to a single supplier for all services to address both data and illiquid asset difficulties, then to a master trust, and lastly ensuring members’ benefits by the buyout.”

Since the Department for Work and Pensions (DWP) published its white paper on ‘preserving defined benefit pension schemes’ in 2018, an array of new products and solutions have arisen in the market to assist trustees and sponsors in implementing consolidation measures.

Excluding from the broader public sector, the great majority of UK businesses are currently offering defined contribution (DC) schemes to existing employees. For newer developments, integrated DC configurations are ‘the standard’. Over the last decade, several previously ‘unbundled’ own-trust DCs have likewise embraced a streamlined structure.

The accomplishments of consolidation in DC will provide a strong incentive for trustees and sponsors to investigate how they may benefit from comparable economies and advantages of scale on the DB side. And, given the variety of alternatives now available for DB plans, there is likely to be an amalgamation strategy that will benefit your plan no matter where you find yourself on your path.

Combining any or all aspects of your strategy’s management can result in considerable savings in both time and expenses, as well as improved quality and reduced (or, in some circumstances, eliminated) the strain on your trustees.

The Positive Impact of DB Pension Scheme Consolidation

Diminished Outlays

There are significant financial benefits to consolidating Defined Benefit (DB) pension systems. Consolidating several defined benefit plans (DB plans) into a single structure enables economies of scale in situations where administering pension obligations may be complex and resource-intensive. Through this consolidation, administrative procedures are streamlined, redundant work is removed, and the advantages of bulk purchasing are utilised. Businesses that centralise leadership, compliance with legislation, and investment management can save a significant amount of money.

Moreover, consistent integration of DB plans promotes better communication amongst pension plan members, which raises participation and increases participants’ awareness of their retirement benefits.

More Strict Regulation

It is possible to create an administrative system that is more robust and efficient by combining many schemes into one unified structure. This focused strategy facilitates decision-making by outlining roles and optimising routes of communication. Faster reactions to shifting regulatory requirements, the economy, and economic conditions are made possible by improved governance.

A well-established defined benefit plan typically possesses a specialised governance team that can focus on developing strategies, managing risks, and adhering to changing pension laws, promoting an informed and proactive approach.

The Handling of Risk

Combining several DB pension systems is a risk management strategy that diversifies investment portfolios. The effects of market volatility on the assets of the pension fund are lessened by this diversification. Combining resources and assets from many schemes is possible with a consolidated approach, resulting in a more comprehensive and diverse investment plan.

As a result, the risk profile of the pension plan as a whole is more evenly distributed, which reduces its vulnerability to specific expenses, subpar performance, and financial concerns.

Obtainable Capital

Pension funds now have more investment capacity and access to a broader range of investment alternatives because of consolidation, which makes it possible to create larger, more varied asset pools. Bigger asset pools often make it possible to make direct investments in more asset classes, such as infrastructure, private equity, and other alternative assets, which may be difficult for smaller, dispersed schemes to access on their own.

Market Research Techniques for Assessing FinTech Competitive Landscape

Success in the quickly changing field of financial technology, or FinTech, depends on being one step ahead of the competition. Comprehending the competitive environment is crucial for FinTech enterprises seeking to discern prospects, foresee challenges, and set themselves apart in the marketplace. Good market research methods are essential for evaluating the FinTech industry’s competitive environment since they offer insightful information that may guide strategic choices and spur company expansion.

Market Research in FinTech

It’s critical to emphasise the value of market research in the FinTech sector before delving into particular methods. The competitive environment is always changing as new firms emerge and incumbent ones extend their offers. FinTech firms may efficiently traverse this shifting terrain by obtaining the required knowledge through market research.

Any successful market research plan starts with a thorough industry study. In order to comprehend the wider environment in which they function, FinTech organisations need to evaluate macro trends, market dynamics, and regulatory developments. Businesses can find chances for expansion and possible risks to their operations by examining variables like market size, growth forecasts, and competition intensity.

Competitor Analysis: Identifying Strengths, Weaknesses, and Differentiators

Analysing competitors in-depth is crucial to comprehend the advantages and disadvantages of major FinTech companies. Businesses might find opportunities to obtain a competitive edge by examining the goods, prices, distribution methods, and marketing initiatives of rivals. FinTech firms may successfully position themselves in the market and communicate their unique value proposition to clients by establishing significant differentiators.

Customer Research: Understanding Needs, Preferences, and Pain Points

Businesses may create goods and services that appeal to their target market by learning about the wants, requirements, and pain points of their target consumer base. Strategies like focus groups, interviews, and surveys may yield insightful information on consumer behaviour that helps FinTech businesses better customise their products to fit the demands of their target market.

Technology Assessment: Evaluating Innovation and Disruption

Technological innovation is a major source of competitive advantage in the quick-paced FinTech industry. FinTech businesses need to keep up with the most recent technology advancements and evaluate how they can affect the sector. Businesses may see new trends, analyse emerging technologies, and foresee any disruptions to their business model by performing technology assessments. As a result, businesses may keep their competitive advantage in the market and proactively adjust to changes in technology.

Market Segmentation: Identifying Target Markets and Customer Segments

In the FinTech sector, market segmentation is crucial for efficient targeting and positioning. Through market segmentation based on behaviour, psychographics, or demographics, businesses may better target their product offers and marketing campaigns to certain client requirements and preferences. As a result, businesses can deploy resources more effectively and increase the return on their marketing and product development investments.

SWOT Analysis: Evaluating Strengths, Weaknesses, Opportunities, and Threats

An effective method for evaluating the competitive environment in the FinTech sector is a SWOT analysis. Through a methodical assessment of their advantages, disadvantages, prospects, and risks, businesses may obtain a thorough comprehension of their market situation and pinpoint chances for enhancement. This enables businesses to successfully address shortcomings, seize opportunities, build on strengths, and counteract threats.

Conclusion

To sum up, efficient methods for doing market research are crucial for evaluating the FinTech industry’s competitive environment and creating a competitive edge. FinTech organisations may obtain significant insights that support strategic decision-making and propel corporate growth by doing thorough competition, industry, customer, and technology assessments, as well as market segmentation and SWOT analysis. FinTech firms may maintain a competitive edge and set themselves up for long-term success in the ever-changing and dynamic FinTech industry by strategically utilising market research.

14 Spring Cleaning Tips for Your Personal Finances

As flowers bloom and the sun lingers longer in the sky, spring signals a fresh start. This season, consider extending the traditional spring cleaning from your home to your personal finances. A thorough “spring clean” of your finances can help set you up for financial success for the rest of the year. Here are 14 essential tips to streamline, organize, and rejuvenate your financial life.

1. Review Your Budget

The first step in any financial spring clean is to take a hard look at your budget. Has your income or spending changed recently? Adjust your budget to reflect your current financial situation, ensuring every dollar works towards your goals. Regular budget reviews prevent surprises and keep you on track toward financial stability.

2. Track Your Spending

Understanding where your money goes is crucial in managing personal finances effectively. For a month, keep a detailed log of all your expenditures. You might discover unnecessary expenses you can trim, freeing up money for savings or paying down debt.

3. Update or Create Financial Goals

Spring is the perfect time to set new financial goals or update existing ones. Whether it’s saving for a vacation, buying a home, or preparing for retirement, clear goals motivate you to stick to your financial plan and make informed spending choices.

4. Check Your Credit Report

Regularly checking your credit report is an essential part of maintaining your financial health. Spring clean your personal finances by requesting a free credit report from each of the three major credit bureaus. Look for any discrepancies or errors and address them promptly to protect your credit score.

5. Declutter Your Subscriptions

Subscriptions can take a toll on your budget without you even realizing it. Evaluate all your subscription services, from streaming platforms to gym memberships, and cancel any that you no longer use or need. This can significantly reduce monthly expenses and streamline your financial commitments.

6. Consolidate Your Accounts

If you have multiple bank or investment accounts, consider consolidating them. Fewer accounts mean less paperwork and easier management. It also reduces the risk of missing out on crucial notices or fees that could affect your personal finances.

7. Organize Financial Documents

An organized system for financial documents is key to a successful spring clean. Keep important documents such as tax returns, investment statements, and insurance policies in a secure and easily accessible place. Digitize documents where possible to reduce physical clutter and enhance security.

8. Plan for Tax Season

Even though tax season may have just ended, now is the time to plan for next year. Adjust your withholdings if you owed a significant amount or received a large refund. Organize receipts and track deductions throughout the year to make the next tax season smoother.

9. Review Insurance Coverage

Your life changes, and so should your insurance. Review your health, home, and auto insurance policies to ensure they still meet your needs. Better coverage can prevent financial disasters, and sometimes, adjustments can also lower your premiums.

10. Automate Savings

One of the best ways to ensure you continue to save is to automate it. It’s easy to set up automatic transfers to your savings account for immediately after each payday, as most banks and credit unions offer the feature. Plus, this “pay yourself first” approach ensures saving takes precedence over spending.

11. Reduce Debt

Reducing debt should be a priority in your financial spring cleaning. Identify the highest-interest debts and focus on paying them down first. Consider transferring credit card balances to a lower-interest card or consolidating debts to simplify payments and reduce interest costs.

12. Maximize Retirement Contributions

Spring is an excellent time to evaluate and possibly increase your contributions to retirement accounts such as a 401(k), IRA, or any other pension plan you might have. Check if you’re on track to meet your retirement goals and adjust your contributions accordingly. If possible, increase your contributions to the maximum allowed to take full advantage of tax deferrals and any employer matches. Regularly increasing your retirement savings can significantly impact your financial security in the long term.

13. Review Your Financial Advisors

Spring is a great opportunity to reassess your relationship with any financial advisors, including accountants, financial planners, or investment advisors. Ensure that they still align with your financial goals and values. If you don’t currently have a financial advisor, consider whether hiring one might benefit you, particularly if your financial situation has become more complex. An expert’s guidance can be invaluable in navigating investments, retirement planning, and tax strategies, ensuring you make the most informed decisions for your financial future.

14. Set a Date for Next Year’s Financial Spring Cleaning

Finally, make this financial spring clean a yearly ritual. Set a reminder for next year to revisit and refresh your financial strategies. Regular updates will help you adapt to changes in your financial situation and keep you focused on your long-term objectives.

Use These Spring Cleaning Tips to Get Your Personal Finances in Order Today!

Spring cleaning your personal finances involves more than just a quick review; it’s about setting yourself up for financial health and security. Following these 14 tips ensures that your finances are organized, your goals are clear, and your future is brighter. Start today, and feel the weight lift off your shoulders as your financial worries clear away, just like the last chills of winter.

Read More:

From Broke to Financially Woke: 10 Strategies That Can Turn Your Life Around

16 Words That Always Spark a Debate on Pronunciation

Pronunciation can be a contentious topic, with regional dialects, accents, and linguistic evolution often leading to disagreements over how certain words should be spoken. In today’s interconnected world, where communication knows no borders, debates over pronunciation have become increasingly common. Here are sixteen words that consistently ignite passionate discussions on pronunciation, reflecting the diversity and complexity of the English language.

1. Tomato

One of the most famous pronunciation debates centers around the word “tomato.” While some people pronounce it with a short “a” sound (“tuh-may-toh”), others use a long “a” sound (“tuh-mah-toh”). This difference in pronunciation is often attributed to regional variations and cultural influences.

2. Potato

Similar to “tomato,” the pronunciation of “potato” also varies widely. Some pronounce it with a long “a” sound (“puh-tay-toh”), while others use a short “a” sound (“puh-tah-toh”). The debate over the correct pronunciation of “potato” has been a source of amusement and disagreement for centuries.

3. Caribbean

The pronunciation of “Caribbean” is another hotly debated topic. Some people pronounce it with the stress on the first syllable (“kuh-RIB-ee-un”), while others emphasize the second syllable (“kuh-rih-BEE-un”). Both pronunciations are widely accepted, adding to the confusion surrounding this word.

4. Aluminium

The word “aluminium” is pronounced differently in British and American English, leading to frequent debates over its correct pronunciation. In British English, it is pronounced “uh-LOO-mi-ni-um,” while in American English, it is pronounced “uh-LOO-mi-num.” This discrepancy in pronunciation has sparked countless discussions among speakers of both dialects.

5. Data

The pronunciation of “data” is a subject of contention, with some people pronouncing it as “day-tuh” and others as “daa-tuh.” The debate over the correct pronunciation of “data” reflects broader differences in regional accents and language usage.

6. Schedule

The pronunciation of “schedule” varies between British and American English, with British speakers typically pronouncing it as “shed-yool” and American speakers as “sked-yool.” This difference in pronunciation can lead to confusion and disagreement, particularly in international contexts.

7. Advertisement

The word “advertisement” is pronounced differently in British and American English, with British speakers typically saying “ad-VER-tis-muhnt” and American speakers saying “ad-ver-TIZE-muhnt.” This variation in pronunciation reflects differences in accent and language usage between the two dialects.

8. Privacy

The pronunciation of “privacy” can vary depending on regional accents and dialects. Some people pronounce it as “PRY-vuh-see,” while others say “PRIV-uh-see.” This difference in pronunciation can lead to misunderstandings and disagreements over the correct way to say the word.

9. Often

The pronunciation of “often” is a subject of debate, with some people pronouncing the “t” sound (“off-ten”) and others omitting it (“off-en”). Both pronunciations are widely accepted, leading to differing opinions on which is correct.

10. Controversy

The word “controversy” is often pronounced with the stress on the second syllable (“kun-TRO-ver-see”) but can also be pronounced with the stress on the first syllable (“KON-tro-ver-see”). This difference in pronunciation reflects variations in accent and speech patterns.

11. Nuclear

The pronunciation of “nuclear” is frequently debated, with some people pronouncing it as “NEW-klee-er” and others as “NOO-klee-ar.” This discrepancy in pronunciation has led to confusion and disagreement over the correct way to say the word.

12. Mischievous

The pronunciation of “mischievous” is often a source of contention, with some people pronouncing it as “MIS-chuh-vuhs” and others as “MIS-chiv-us.” Both pronunciations are widely used, leading to differing opinions on which is correct.

13. Espresso

The pronunciation of “espresso” is frequently debated, with some people pronouncing it as “es-PRESS-oh” and others as “eX-PRESS-oh.” This discrepancy in pronunciation has led to confusion and disagreement over the correct way to say the word.

14. Prescription

The word “prescription” is often pronounced with the stress on the second syllable (“pruh-SKRIP-shun”) but can also be pronounced with the stress on the first syllable (“PRES-krip-shun”). This difference in pronunciation reflects variations in accent and speech patterns.

15. February

The pronunciation of “February” is frequently debated, with some people pronouncing it as “FEB-roo-air-ee” and others as “FEB-yoo-air-ee.” This discrepancy in pronunciation has led to confusion and disagreement over the correct way to say the word.

Pronunciation Debates

In conclusion, pronunciation debates are a common occurrence in the English language, with differences in accent, regional dialects, and linguistic evolution often leading to disagreements over how certain words should be spoken. While some words have widely accepted pronunciations, others remain sources of contention and debate, reflecting the complexity and diversity of the English language. Regardless of individual preferences, the key is to communicate effectively and understand that language is fluid and ever-evolving.