Being Rich: The Thousandaire’s Guide for Middle Class Millennials in the US

Making the Most of What You Have (When What You Have is Already Ridiculously Good)

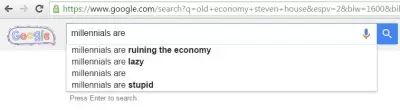

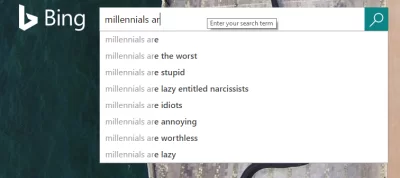

Thousandaire’s Note: If you know the article I’m paraphrasing, you’re awesome and have even fewer excuses than everyone else. Furthermore, I’m going to be making some assumptions in this article. First, that you were born in the US. Second, that you went to college. Third, that you’re reasonably healthy. Fourth, that you’re a millennial. If these don’t apply to you, then feel free to ignore the stern talking-to everyone else is about to get. The people that these assumptions do apply to are generally thought of as being self-important little skid-marks on the underwear of society. Politifact would rate this statement as Mostly True.

Well, screw you too google.

The Basics of Being a Middle Class Millenial

So, you’re a middle class millennial. Or rather, you’re a 27 year old, you’ve got some student debt, and a college degree. You’re underpaid and overworked and everyone has expectations that are too high, including yourself. Weren’t you supposed to be running things by now? Your parents grew up in an idyllic time, houses were cheap and one parent could raise a family of six working a few hours per week at McDonald’s. Immigrants, automation, and/or foreigners are taking all the jobs depending on which party you’ve decided to vote for. Times are different now and you got a raw deal, right?

Wrong. You’ve got a college degree and you live in America. You’re youngish now which means, due to your student debt or some mistakes made with a credit card, some of the poorest people in the world technically have a larger net worth than you. By the time you’re middle aged you’re going to be “poor” to the same extent that Donald Trump’s hair is natural.

As a middle class millennial, you don’t have a lot of money right now, unless you got an engineering degree, you probably aren’t making a lot of money either. Due to inflation in the housing, education, and healthcare sectors you probably can’t afford the housing arrangement you’d like to have right now. You also want to make money at some job that allows you to be fully self-actualized (as you should!) while still raking in mountains of cash.

If you’re a millennial you probably don’t need this update. You already know that housing’s too expensive and that your degree in creative writing totally wasn’t intended for driving an uber around all day.

The Millennial and his Personal Finance Situation, AKA “The Math That Buys Things For You, Stops You From Wasting Money, And Gets You Money When You Need It, While You Do All Your Important Life Stuff”

Traditional personal finance advice is about controlling three simple things. Handling money you spend, money you keep, and money you make. We’re going to add one more, making sure you have a good time doing it.

Your job is to do whatever it is that makes you happy, excites you, or makes you feel fulfilled, unless it falls into the category of “spending money”, “handling money”, or “making money that isn’t being shoveled at you simply because you’re fulfilling yourself”. Since this is the US, people often think that, “whatever it is that makes you happy” will mostly be spending money on things or “experiences” (If an important component to of things/experiences is that you spent money on them, please never contact me, we have nothing in common). Occasionally you do need money to fulfill your dreams and to this end, you will handle your finances in a sensible fashion, making use of the three major advantages you have over basically every person on the planet. Your US citizenship, your degree, and your status as a healthy human being.

Income

The median college starting salary is $45,000. The median starting salary for liberal arts/humanities major (news flash, this group has the lowest starting salary of college grads) is $36,347. Assuming that you’re getting an income somewhat below the typical humanities major we’ll look at the 25th percentile salary: $33,471. Where does this put us relative to the rest of the US? Top 71%. Now you might understand why some older folk are calling you a “self-important skid-mark”, 70% of the country makes less than you. How does this compare world-wide? You aren’t going to like it. To be in the top 1% of worldwide income you need to make ~$35,000 per year. You might be inclined to say, well, stuff’s really cheap in poor countries. Turns out economists account for stuff like that when they do calculations like this. Who’da thunk? Now if you make $33,000, technically you’re still part of the global 99%. Technically the Earth isn’t a sphere, it’s a shape called a geoid (the hypothetical surface of mean sea level worldwide if water could flow freely through continents) plus local topography. That may be true, but if you bring it up all the time you’re eventually going to get your teeth punched in.

So why is it that $33,000 feels so poor when in reality its so rich? This is just about the oldest story in the world. Fellow makes $X, “needs” to spend $X+1, wants to spend $2X. This was an old story when it showed up in Richest Man in Babylon, making this one officially older than sliced bread. If you feel poor and you’re in the global 1%, you probably need to review your budget and take a look at what you’re spending your money on.

Spending

You probably spend money. Money can do lots of different things. There are several general categories of spending:

–Housing: This is shelter. It helps you rest without being eaten at night. It also makes it more difficult for weather to kill you. It also provides a good place to sleep and throw wild parties. If you’ve got a typical salary for a college educated millennial, figure out how to spend between $300 – $600 monthly on this. You spent all of college telling people that your philosophy degree (possibly the best degree, in my view) was going to equip you with great critical thinking ability, use it.

–Food: Stuff that provides you with energy to make more money and also do everything else interesting. Bonus, it usually tastes good. You want to spend between $100 and $200 monthly on this. You can probably do better than that. This is an area where skill can often substitute for money to get an equivalently healthy and tasty dish. Whenever you can substitute skill for money you should. If only because it makes you a more interesting person. (Of course I can’t cook my way out of a paper bag, but that also explains why this area is my biggest bit of spending idiocy.)

–Healthcare: This helps make sure that you don’t die of some awful infection just because you got a scratch one day. You might be healthy now, but you will always be the oldest you have ever been. In turn that probably means that you’re always at your highest risk of having some dumb health thing happen to you. This is important. Don’t skimp. If you’re healthy that means spend whatever it costs to get a health insurance premium appropriate for your temperament. You will get a tax refund for some of this premium if you’re as poor as you think you are. Don’t be surprised about anything up to $500 per month. Also, put aside at least 1/12th of your annual deductible every month. If you have a high deductible plan this money goes in an HSA.

–Investments and Assets: This category includes anything that does something that saves you money, or directly makes you money. Budget about half of your money for this. If you’ve ever played a video game in your life you know why. If you haven’t…I guess I just have no words.

—Stocks: These are basically a method by which you share in the profits of a going-concern (read: company). This is good because profits are what you’re trying to make with investments. There’s no budget in here for selling stocks. You’re trying to own pieces of businesses. It doesn’t get any easier if you end up selling a bunch of them. Example: A Coca-Cola dividend reinvestment plan.

—Mutual Funds: These aren’t exactly stocks, but they might as well be. It’s cheap diversification across many companies, and it makes your profits somewhat less swingy. The rule of thumb with these is that cheaper is better and more generic is better. A 3x oil fund with a 2% expense ratio is probably pretty terrible. A Total Stock Market fund with a 0.1% expense ratio is pretty good. Example: An S&P 500 Index Fund.

—Bonds: These don’t make very much money, but they certainly make it a lot more consistently. Investment grade bonds and bond funds are a category. If you include junk bonds the line between these and stocks is pretty blurry. Right now interest rates are low, which means bonds are expensive. Of course a couple years ago I was saying that bonds couldn’t go higher because interest rates were so close to zero, then in many places they went negative. That tells you exactly how valuable my advice on the bond market is.

—Annuities and Life Insurance: As investments, these by and large, suck. Occasionally, they’re useful, but when a good millennial wants money, he makes it from investments in actual businesses. If it’s a lot of money, he works himself. You do need to have life insurance if you have dependents to make sure they don’t starve if you die, but that is an expense, like health insurance and you get term life insurance. Anyone who says that whole life insurance is some kind of investment is selling.

—Cost Reduction Tools: These investments change spending in your favor. They make it cheaper to do the things you have to do or otherwise get you what you want more cheaply, they save you time (assuming you use that time to make more money, otherwise this is just an expense!), and so on. Examples: Solar Panels, Paying off a loan.

—Local/Your Own Business: These investments do bad things to people, and people often can’t do a damn thing about it. Plenty of people have invested in their uncle’s automated toilette paper dispenser only to see their investment go up in smoke. Running your own business well is also often how people get stupid rich in this country (it’s hard to find anyone on the billionaires list who didn’t get there by doing this). Not too many of that kind of opportunity, but they’re so damn good. This is one of the main benefits of a US citizenship. Compared to many other countries in the world, it is really easy to start a business, lose all your money, pick yourself up, dust yourself off, start another one, lose all your money again, start a third one and earn an embarrassingly large amount of money. Fortunately, you also have some degree of control over the risk you put into this. In most businesses sweat can be substituted for cash. If you made it through college you at least know how to do that much.

–Transportation: This is good because sometimes you’d rather be somewhere else. People often justify this as a need because their work is far, and they’re unwilling to spend 5 minutes coming up with some solution other than a $30,000 car. Clever folks don’t make a 2 ton vehicle carry their 0.07 ton body back and forth to work. Healthy folks bike. Smart folks invent a teleporter. Ultimately, you want transportation to cost half of what your housing costs, all-in. This can be tough. If you want somewhere to get started look here.

–Useless Crap: Some spending is just a plain waste, period. This category covers things like bottle service, luxury candles, 3-D movie tickets, and a storage unit to shove it all in. (I admit it, I’m sometimes guilty of spending waaaay too much money on the dubiously labelled “entertainment” category in my budget software of choice.)

$500 on Housing? $200 on Food? Are you insane?

Nope. Fortunately this is all quite achievable, even in more expensive cities. We’ll dig into all of these things in more detail in the coming weeks. Special thanks to Logic Ninja for his very similar guide on an entirely different topic.

Adam Woods is a physicist. His research interests include building software to run and build geomagnetic models. Adam got interested in personal finance in the great recession when it became obvious an interest was necessary.

After harassing his friends and family (and a short intervention) he took to the web where he blogs about finance, investment, politics, and economics.

Adam is currently located in Boulder, Colorado where he can generally be found hiking, biking, or running a D&D campaign. He can also be contacted at adamwoods137@gmail.com.