This is part 3 in a series of articles on how to start a business. For those who haven’t read them here are part 1 and part 2. I am basing these articles off of the SBA ten step plan.

Step 6: Register a Business Name

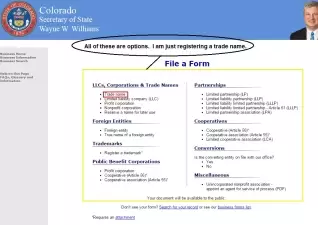

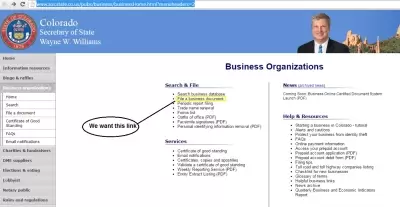

This is sometimes called a DBA (stands for “doing business as”) name. This turned out to be flatly easier than I really anticipated it to be. The SBA webpage has links to different state webpages. The one for Colorado, which I’ll be using as an example is here. Click on the “File a business document” link.

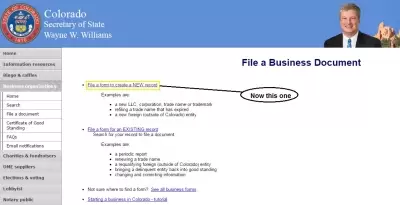

Then click on the File a form to create a NEW record:

Finally in order to register my sole proprietorship I need to click on the “Trade Name” link.

Here we are at yet another screen. Makes you wonder how many forms there must be to have this many layers of this many options…

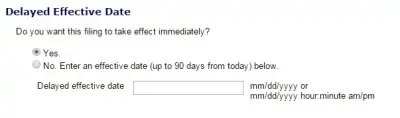

Now that we’re onto the form you’ll notice that we’re going to get charged $20. A surprisingly reasonable fee in my view. To be entirely honest I thought this was going to be somewhat more expensive. The form starts out straightforward. What’s your address etc. You’ll need to know what you want your “trade name” to be. The question here is, “what is the name of your business”. Hopefully you can answer that by now. There’s an additional section I found interesting though. The “delayed effective date”. Why would I want this?

This could be useful if you were converting a sole proprietorship to some other form of entity that was taxed a little differently. By filing with a delayed effective date you can make sure that the business takes its new tax treatment exactly on the first of the year or something useful, so that you don’t have to file an extra form for one year. Additionally, sometimes States get swamped with new business filings. If you wait until you need the business created then choose for it to take effect immediately you may have to wait longer for confirmation. If you file in advance and choose the delayed effective date you can control what day it begins on because you’ll be at the front of the line.

Step 7: Get a Tax Identification Number

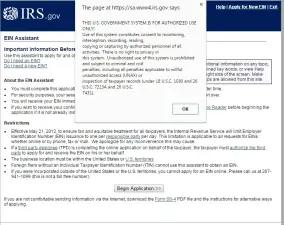

To apply for an EIN (employer identification number) you have to go to this webpage. You can also do it by mail, but honestly, how crazy would you have to be? (Very). Judging from this questionairre I’m actually not required to get an EIN. I think I’ll go ahead and do it anyway, maybe I’ll end up hiring a secretary or something.

Fortunately the process is pretty simple. We do need to keep track of the Doing-Business-As name that we signed up for in Step 6. All-in-all this turned out to be more intimidating than it was difficult. Looking at all this I start to wonder how hard it would actually be to hire an employee.

Adam Woods is a physicist. His research interests include building software to run and build geomagnetic models. Adam got interested in personal finance in the great recession when it became obvious an interest was necessary.

After harassing his friends and family (and a short intervention) he took to the web where he blogs about finance, investment, politics, and economics.

Adam is currently located in Boulder, Colorado where he can generally be found hiking, biking, or running a D&D campaign. He can also be contacted at adamwoods137@gmail.com.