For those of you stock market investors out there, what is the most important thing you look for when trying to identify an online brokerage account?

In my mind there’s only two ways for an online stock trading service to differentiate themselves from the rest of the pack: they need to offer cheap trades (most important) and they need to provide good information. I was given an opportunity to try Kapitall the other day and wanted to share my thoughts on the service.

Trading Fees Could Be Better

The most important aspect of an online brokerage, in my opinion, is the cost to make a trade. The lower the trading costs, the less money you give to the brokerage and the more money you get to keep for yourself. And more money = good, right?!

Kapitall charges $7.95 per trade. Considering other places offer trades for under $5, they aren’t the cheapest guys on the block. However, they are running a promotion right now that can save you $7.95 per trade (that means it’s free!)

For one hour every day (check Kapitall’s twitter account for the hour) they offer four free trades. Free is my favorite price, so this makes me very happy. I can easily limit my trades to one hour a day to get free trades. However, I would like to see two changes to “Happy Hour”.

First, the trade fee is charged during your purchase and then credited back to your account at the end of the day. This is frustrating because 1.) I feel like I have to log in at the end of the day to make sure I got my credit (which did go through without a hitch) and 2.) Because it gives me $7.95 less to use for investing.

Second, I’d like it to be made permanent. When this promotion goes away, you’re left with a brokerage that charges $7.95 a trade. As a casual investor, pretend I make 10 trades a year; That will cost me $79.50 with Kapitall, whereas it will cost me $40-50 at a cheaper brokerage. I’d rather save $30-40.

Research is Pretty Darn Good

When I’m considering a company, the first thing I want to look at are the company’s financials. I haven’t really found a site that displays financials in a clear, easy to understand manner.

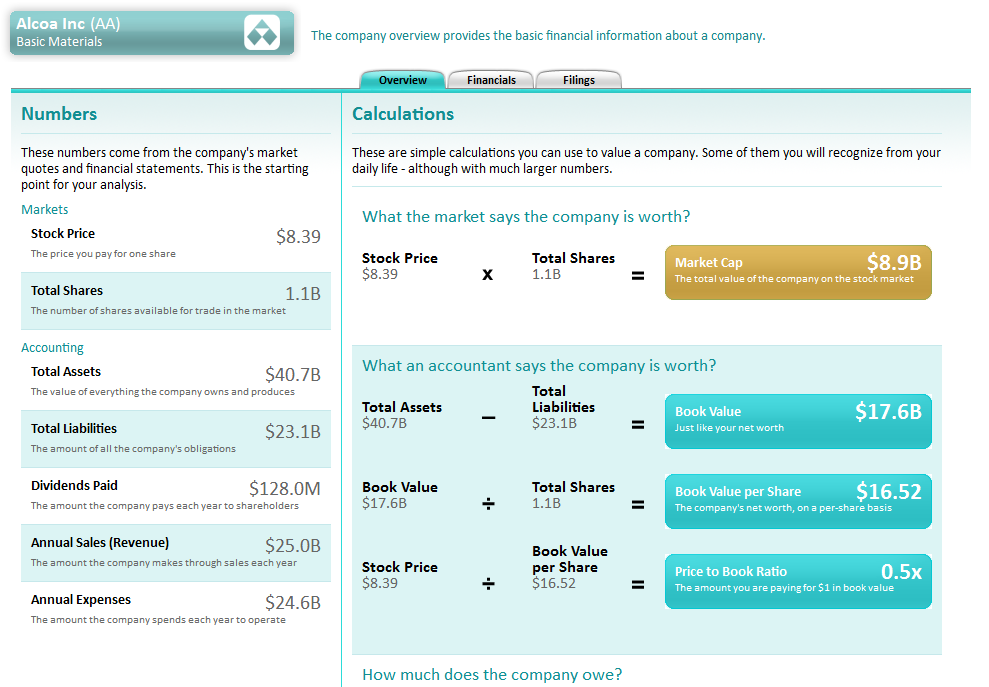

That is until I looked at the Number Cruncher on Kapitall. Take a look at this screenshot of what I get to see:

For people like me who aren’t investing experts, this is an incredible view. It gives easy-to-understand explanations of financial terms like “Market Cap” and “Book Value”. It gives a variety of different views that are very helpful when deciding if a company is a good investment.

For people who like to do research, Kapitall has really set up a great tool for that.

They have much more than financials too. They have analyst ratings, news, charts, and more. I have used a few online brokerages, and Kapitall is light years ahead of others I’ve used when it comes to research and content.

Extras Are Pretty Good Too

While I don’t personally care much about a pretty user interface when trading stocks, I do have to mention that Kapitall has some intangibles that do make it interesting to say the least.

They have a whole system of drag and drop that makes trading stocks seem kind of like a game. They also give you points and medals, which is definitely appealing to my generations of video game enthusiasts (so what if I bought the new Spider-Man video game today and played it for 3 hours???).

It is a cool way to trade stocks, although it’s a bit confusing at first and might turn some people off before they figure it out.

My Verdict on Kapitall

Overall I really like the information provided by Kapitall. It makes researching stocks very easy. However, I’m cheap and I just can’t see myself paying for $7.95 trades when I have other accounts that can do it cheaper. If they made Happy Hour permanent or dropped the price to $4.95 a trade, I would strongly consider moving my account here.

If trading costs are your most important criteria, I’d avoid Kapitall. However, if you like great information and a fun interface and don’t mind paying $7.95 a trade, this might be your next brokerage. If you do want to sign up, you can even get a $25 credit in your account!

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Just taking a look around it isn’t the worst place for someone to open a taxable account if they don’t have a lot of cash laying around (since there are not any account minimums). If I were going to invest entirely in ETFs I would probably pick a different brokerage since most of them offer free trades for their ETFs.

Thanks for the objective write up on them. I think I’ll pass of them for now.

Interesting review, Kevin. A lot of the online brokerages I have looked at charge $9.99 per trade plus a maintenance fee. I haven’t settled on one yet, but it seems to me that even if you pay less per trade but then get charged an account maintenance fee every quarter, there goes your $30-40 per year, plus maybe more. I won’t make a whole lot of trades each year and so don’t mind paying a little bit more for a good product. With no extra charges (it doesn’t look like) and regular promotions to offset trading fees, though, maybe this one would end up costing less?

I love Scottrade! $7 a trade, no other fees. They also have local offices so we can stop in anytime.

I am a newbie at investing and I enjoy the thought of dividend investing. I love this blog and a handful of others that I read, learning allot and starting to get my feet wet. I started using Sharebuilder what are your thoughts about that site? In the “basic” account trades are a low $4.95 but the “advanced” account is $12.00 a month and that includes (12) free trades and every trade after that is just $1.00. The research is there too, many different detailed views, why do you use the broker site you do? What books do you recommend for me to read? Is there a min amount of money someone should save before they start investing?

How hard would it be to just write a Java (or some other language) program to do all those calculations for you? I’m sure all the formulas are public knowledge. You could even use the results from your stock picking experiment to review the history of the company and give you a recommendation (I may be reaching now).