I’ve now owned a home for about a week and I spent a lot of money on the down payment, closing costs, and of course all the tools and materials to do renovations in my new home. I pulled money out of my Roth IRA and took a 401k loan for the down payment, and have been using money from my savings account to pay for the renovations.

But there’s one place where I haven’t touched a dime: my Lending Club account.

I haven’t withdrawn anything from my Lending Club account because 1) it’s not easy, and 2) the returns are too good.

Selling Lending Club Notes Takes Time

When you are looking at a Lending Club account, you have two different kinds of assets. You have notes, which represent money owed to you by a borrower. You also have cash, which is a combination of cash you have deposited and cash received from monthly payments on your notes.

The cash is easy to get to; it can be withdrawn at any time via a wire transfer or bank transfer.

The notes can’t be withdrawn because they are not actually money. A note can be turned into cash, but that means it needs to be sold to someone else who is willing to take on the loan.

To sell a note, you need to determine which notes you want to sell, how much you want to sell them for, and then hope there is someone looking to buy notes that finds yours priced appropriately. You might sell a note in a few hours, but it could take days or weeks and a few price adjustments before you get a fair price for your note.

If want an investment that is liquid then Lending Club is not right for you. On the other hand, if you like the idea of making your money hard to access (thus forcing you to save) then Lending Club is a great option.

Lending Club Returns are Hard to Pass Up

The other reason I’m not cashing out my Lending Club investments is because I’m making too much money!

The stock market scares the crap out of me (even though I still have a lot of money in the market through my 401k) and I want to get decent returns outside of the stock market.

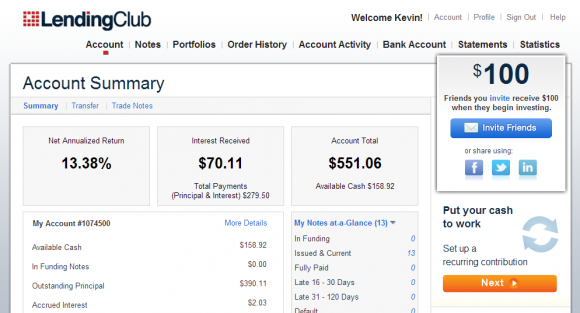

How does 13.38% sound to you?

In the stock market I never know what’s going to happen and I have no idea what the companies I invest in are really doing with that money.

With my Lending Club investments I am getting a solid 13% return, I know exactly what the money was used for, I’m getting cash payments every month, and for the most part I’m helping my fellow Americans pay off high interest debt (because almost all of my Lending Club notes are debt consolidation notes).

I’m Keeping My Lending Club Investments

I sold every stock I owned (aside from 50% of my 401k) to buy my house, but I didn’t sell one single Lending Club note because I believe in peer to peer lending and the returns speak for themselves.

Let me be clear: if you want a liquid investment then Lending Club is not the place for your money.

But if you are content to buy and hold and enjoy monthly cash payments then Lending Club is as good as it gets as far as I’m concerned.

Readers: Do you have any investments that you aren’t willing to get rid of for any reason (barring emergencies)?

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

This is a joke right? You have a massive investment here generating about $50 a year in solid income.

And , no, you have no idea what the money is used for. I can take out a loan saying it is to help my poor grandma pay her bills, but turn around and spend it at the local strip joint. And then not pay it back. Lendingclub does not realy do much about defaults and you can say good bye to your investment.

The reason I don’t have more money in Lending Club is because I can’t originate loans and it takes a long time to find good notes to buy on the “market”. When I’m busy I don’t have time to spend 30 minutes to find $50 or $100 of investments.

And yes, someone could get their money and spend it on whatever they want. They might not pay it back. But historically the returns have been very good.

Historically the stock market returns have been very good too….

For me the only reason I don’t do lending club is because I cannot orginate loans either. I did read your post about how you screen your choices and it was very informative, but I just cannot take the plunge myself.

I don’t gt it how it can be as high as 13%, for the lender it is less good than bank for any reasonable reason (house, car, school). So what for the guys lend your money for?

I see that it is better than credit card, but then again I would not lend money to a credit card addict.

Do you know how your account with Lending Club affects your credit? (Just curious)

Good stuff.

I’ve been curious about P2P lending for a while. I’m curious – how many hours have you put into this (management, transfer of money, authorization, etc.) in the last 12 months?

Sadly, I can’t do Lending Tree in Texas. But, you asked what investments we wouldn’t touch. When we were closing in October, we made the deal that we would sell stocks if we needed any extra cash but we refused to touch our retirement accounts. So we left the Roth IRA’s and my old 401(k) alone. We used cash that was making less than 1% and haven’t touched the stocks yet. Although we may sell them now to pay off the last $23,000 of our rental house mortgage and then finish maxing out our Roth IRA’s for 2012…

I am glad you made this post. I have been with Lending Club and I absolutely love it! I have 80% of my Roth IRA in Lending Club and the rest for stocks. It has been so much less stress than managing stocks all the time! I invest mostly in A and B grades and I am currently generating 13.24%, so Kevin’s return is not a “fluke”.

My main screening for investing is to only put $25 per note no matter what. Also, I only invest in loans less than or equal to $3000 (I like the idea of someone paying off $3000 in 3 years, rather than $10,000 in 3 years). Also, I invest in notes with as low a Debt-to-Income ratio as I can find (15-20% is my max). They have to have a steady, good income as well, as in, employed for at least 3 years with a gross monthly income at least 20 times their monthly payments for the loan. (meaning, if this note requires them to pay $100/month, I want their income at least $2000/month).

I have not had a single default yet, only early fully paid loans. That is fine with me, there is no fee/risk for the investor if the loan is fully paid off earlier and it is good to know that the borrower is in good shape. I just receive all my principal back to invest in another note.

I guess Im more of a stock man myself. I might invest in lending club notes at some point in the future, but I have none right now.

Returns might be good, but it appears that prehaps some of the people lie about thier income and or DTI on the site. How, for instance, does someone making over $7,100 a month with a DTI of just 14% need a debt consolidation loan? It seems that he would have plenty of cashflow to cover that 14% DTI. Plus that would mean he has about $12,000 in debt (14% of 85K) but yet he is asking for a $15,000 loan at over 7% – sounds fishy because anyone making that kind of cash with such a low DTI should already have better interest rates on his loans, and can get a better rate at a bank (assuming he needs to consolidate credit card debt) if his credit score is indeed 695-699. Some thing about that note sepecifically doesn’t add up to me – luckly there are plenty of other notes to chose from.

And please steer clear of the guy down in “G” class making “14K” each month asking for $30,000.

Interesting site, I will probably give it a go some day, but these borrowers dont offer balance sheets, cash flow statements, income statements, ect, so its probably a lot more difficult to evaluate notes in the same way you might evaluate stocks.

As for my investments I wouldn’t sell right now… V, O, OII, OXY, PG, JNJ, KO, MCD, COP, PSX, NJR, NSC. All stocks – all paying dividends. I like income too. 15+% in my 401K ytd, unknown % in my IRA.