So in December the Fed hiked rates 0.25%. Now you want to know how this should effect your investing strategy. The short answer is that it shouldn’t. If you do anything differently because of the rate hike, you are over-reacting. The Fed rate hike, however, might have some impact on you. Let’s really quickly go over what a rate hike is and what it does and doesn’t impact.

What is the Fed “hiking”

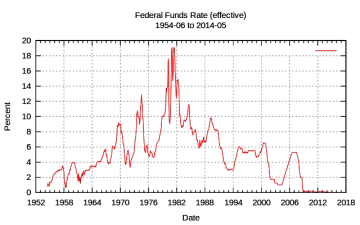

When the media reports that the Fed is hiking rates, they generally mean the Fed Funds Rate. This is the interest rate that banks charge each other to loan money overnight. In turn the overnight rate directly impacts the prime rate, which is the lowest rate at which money can be borrowed commercially. After all, why lend commercially if you could instead simply lend at the overnight rate. This has gone from 0% to 0.25%. In other words you get a quarter annually by lending $100 at the overnight rate, go nuts.

What this directly impacts

Since the prime rate is effected anything set based on the prime rate gets boosted by a tiny bit. This includes credit card interest rates and auto loan interest rate. Now, our goal as Thousandaire’s is to not pay credit card interest and auto loan interest. If you are paying these interest costs this hike is tiny anyway, costing about an extra $2.50 per thousand dollars of debt per year. In principle, this will probably also impact rates offered by short term CD’s and savings accounts. Again this isn’t much, and its starting to look like the Fed might not continue to raise rates [link article on fed rate raising slowdown]. If the rate raise makes you feel that you really need to pay off that credit card or that car, I think that’s great. If it stokes you to buy a three month CD, fantastic. You probably don’t need to worry about it though.

What this does not directly impact

Every day I drive to work I hear some radio commercial about how you need to refinance because the fed is raising rates. This is a load being shoveled by guys who sell mortgages. Mortgages are long term rates, the fed has a very difficult time controlling long term rates. There is some evidence that they were able to push down mortgage rates during QE and “operation twist”. The fed might be able to push up long term rates by selling mortgages and other long term instruments. If inflation expectations stay low and GDP growth stays low long term rates will probably stay low despite a couple small increases in short term rates. Additionally, given negative interest rates abroad, there is a lot of capital in Europe and Japan looking for somewhere safe to invest money. If rates stay negative internationally, I’d bet that mortgage interest rates will stay low. You’ll notice that rates have even dropped over the last month or so. Current 30 year mortgage rate is 3.88% as of February 3rd.

What not to do

In principle increases in the federal funds rate should reduce the value of stocks. The value of a particular stock is the value of all of the future cash flows of the companies discounted to the present at an appropriate interest rate. This means that increases in interest rates reduce the value of stocks in principle. Unfortunately, this is well known, and as soon as rates seem likely to go up the stock market accounts for that information. Even though “rising rates are bad for stocks” you do not sell your stock holdings. You can’t control interest rates. You can’t predict their behavior better than the market (even federal reserve economists have substantial trouble doing this). You can control transaction fees and taxes. Selling generates both. The goal of stock ownership is to treat your ownership interest as an interest in a business and simply sit on it for as long as possible.

Adam Woods is a physicist. His research interests include building software to run and build geomagnetic models. Adam got interested in personal finance in the great recession when it became obvious an interest was necessary.

After harassing his friends and family (and a short intervention) he took to the web where he blogs about finance, investment, politics, and economics.

Adam is currently located in Boulder, Colorado where he can generally be found hiking, biking, or running a D&D campaign. He can also be contacted at adamwoods137@gmail.com.