The MCU films Avengers: Infinity War and Avengers: Endgame introduced a whole generation of fans to Thanos. Thanos first appeared in comic books in 1973. I have been reading about him since I was a child. It amazed me that casuals, or non-comic book fans, had become infatuated with the character and his genocidal philosophy. At the height of Thanos-mania, memes disparaging his philosophy became rampant on social media. And analyzing one of these memes can help explain why making more money won’t solve your problems.

Please bear with me for a few paragraphs as I make a point.

Many people harbor naive beliefs that making more money or getting a raise will instantly solve their problems. But as the Notorious B.I.G. once said in the 1990s, “More money, more problems.”

If you have money problems, a windfall of money or getting a raise won’t solve your problems instantly. Your current problems could potentially become exponentially worse.

So, yes, I am going to tell you three reasons why making more money won’t solve your problems. But please allow me this Thanos-themed allegorical detour to prove my point.

Why Making More Money Won’t Solve Your Problems (The Thanos Problem)

In the early MCU films, Thanos was obsessed with reinstituting balance within the universe so that societies wouldn’t fight or kill each other over scant resources. So, Thanos decided to preemptively and cruelly use the power of the Infinity Stones to randomly exterminate half of the universe’s population

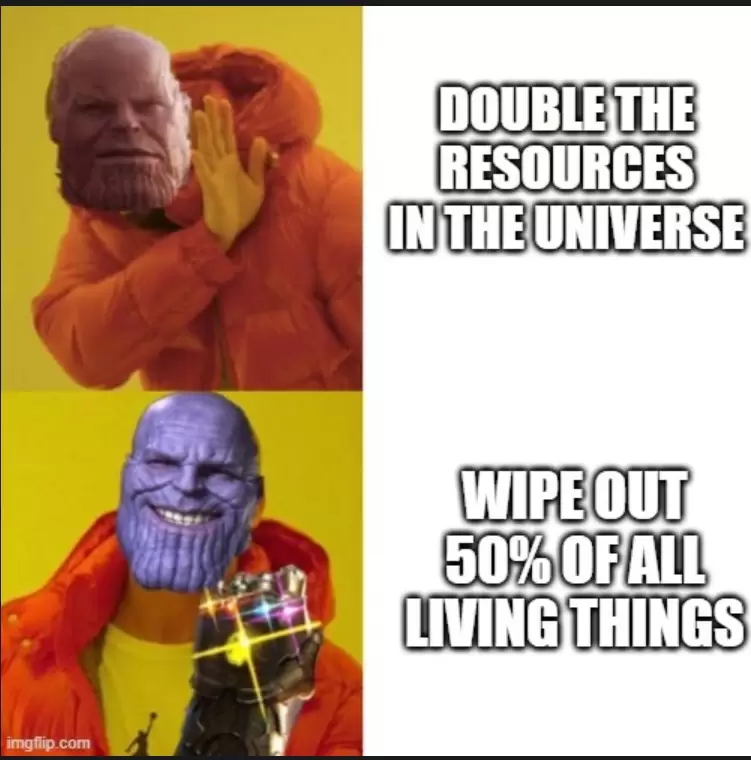

Fans later bombarded social media with memes mocking Thanos’ philosophy. The meme basically said that if Thanos had simply doubled the resources available in the universe, then he could have achieved the same end.

Maybe I am too nitpicky, but it is a wholly naive and contrarian viewpoint. Governments, political factions, criminals, gangs, and rich people hoard or disproportionally control resources. If that is the status quo of the world, and life in general, how is doubling available resources going to solve everything?

Wars are fought over oil. The wars of the future may be fought over dwindling access to potable water.

Consider the state of the real world, right now. Enough resources exist right this second to make the world a utopia – but it ain’t going to happen.

Over 40% of the food produced in the United States is thrown away or wasted annually. Meanwhile, almost half of adults in the Western world are overweight or obese while many in the developing world are malnourished, skinny, or starving.

Over two billion people don’t have access to water or clean water. Meanwhile, people in the Western world waste 67,500 gallons of water on their lawns. If you let a leaky faucet continually drip, then you are wasting 3,000 gallons of water per year.

I could go on. But the point is that the world we have today has enough resources to feed everyone on the planet. But for a myriad of political, economic, and propagandistic reasons, it doesn’t happen.

Poor and working-class people in the USA are told that if they can’t afford healthcare, it’s their own fault and they don’t deserve it. This is a real thing – many notable politicians have publicly stated that the poor do not deserve health care.

If the resources and medical and technological advances of the world doubled or tripled overnight, the last people who would benefit would be the poor and needy (if at all).

A whole new Pandora’s box of crap would be unleashed on the world. If the world suddenly had more food or resources, but without solving the problems that created injustice and inequality in the first place, then societal ills would exponentially worsen, not become alleviated.

The political, economical, and cultural mindsets of the would have to be changed for available resources to be distributed equally and fairly, never mind increased resources.

This brings us back to the title of this article. Are you experiencing unmanageable debt and money problems? Why do you think making more money will solve your problems?

Your financial problems did not occur in a vacuum. If you don’t know what caused your current money problems or are unaware of your behavioral problems with personal finances, then an influx of new money will just worsen your problems, not alleviate them.

Why Making More Money Won’t Solve Your Problems

It sounds counterintuitive, but let’s explain why making more money won’t solve your problems.

Let’s imagine you make an average salary of $52,000 but have severe financial problems. But keep in mind that most Americans make less than that annually. Now let’s imagine that your salary increased to $100K or even $150K.

Here are three reasons why making more money won’t solve your problems.

Financial Literacy

Are you financially literate? Financial literacy is a set of economic tenets that teach you how to manage your personal finances efficiently and perpetuate cash flow into the future.

The three basic tenets of financial literacy are to budget and update the budget regularly, save money, and plan for a financial future. Here is a basic financial literacy guide.

And here is another financial literacy guide that goes a little more in-depth with its lessons.

If you didn’t know how to handle your finances yesterday, how will you magically handle them better today because you have more money?

Consider this fact – over 70% of lottery winners lose all of their winnings within five years. About seven out of every ten people who win the lottery lose it all within a few years.

If you didn’t know how to manage $52,000 without solving your financial problems, suddenly winning the lottery won’t solve your problems either.

Debt Quagmires

A big reason why making more money won’t solve your problems is debt.

Remember, you make $52,000 annually. But the average American owes over $96,300 in personal debts. Americans with unmanageable debt problems usually dedicate 9.5% of their monthly income to paying off their debts.

Imagine your boss gave you a $100K raise. You may have a family and expenses, so all of this money can’t be used to wipe out your debt.

Worse, if your debt mindset hasn’t changed, your debt may increase. Many people have a debt quagmire mindset. In other words, they can’t function in life without debt. Their idea of making money is generating more debt.

If you are in a debt quagmire, the last thing you need is a giant cash influx. Your mindset towards money must change. You need to develop a debt reduction strategy that will help you get out of debt. For example, the debt snowball strategy involves paying the smallest debts in full up to the largest to strategically eliminate debt.

Some people with debt problems pay child support, have their salaries garnished, or declare bankruptcy. In such situations, an influx of new money might initiate a lawsuit.

When you have severe debt problems, don’t bank on having more money to solve them.

Your Mindset About Money

Being financially literate is important. But a big reason why making more money won’t solve your problems is having the wrong mindset.

A mindset is an attitude. And if you haven’t changed your attitude about money, and how you should use it, then even financial literacy won’t matter.

Money is a tool, not an end. The more money you have, the more options you have in life.

So what is your mindset about money? Are you an emotional spender? You may waste money on purchases when you are happy or depressed instead of saving it.

Are you used to spending above your means to maintain a lifestyle you can’t afford?

Do you have any future financial goals? Do you think about investing or launching a business? Or are you continually obsessed with acquiring new material possessions whenever you incrementally deal with debt?

Do you spend money to impress others?

Until your mindset about money and personal finances change, your financial problems won’t change. Even if you suddenly make more money.

Get a Financial Adviser

You can talk to your accountant, bank, or local community center about consulting with a financial adviser.

Seek professional financial guidance to improve your personal finances. The unfortunate reality is that you, your mindset, and your spending habits are probably the primary sources of your financial problems.

Until you solve these issues, making a billion won’t solve your problems.

You don’t need Thanos’ mindset to realize that.

If you are interested in learning how rich people make and keep their money, I highly recommend that you a book called The Millionaire Next Door.

Read More

How Much Interest Will I Earn on $1 Million?

How Can I Become a Millionaire With No Money?

Review: The Millionaire Next Door

6 Best Comic Book Display Shelves

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.