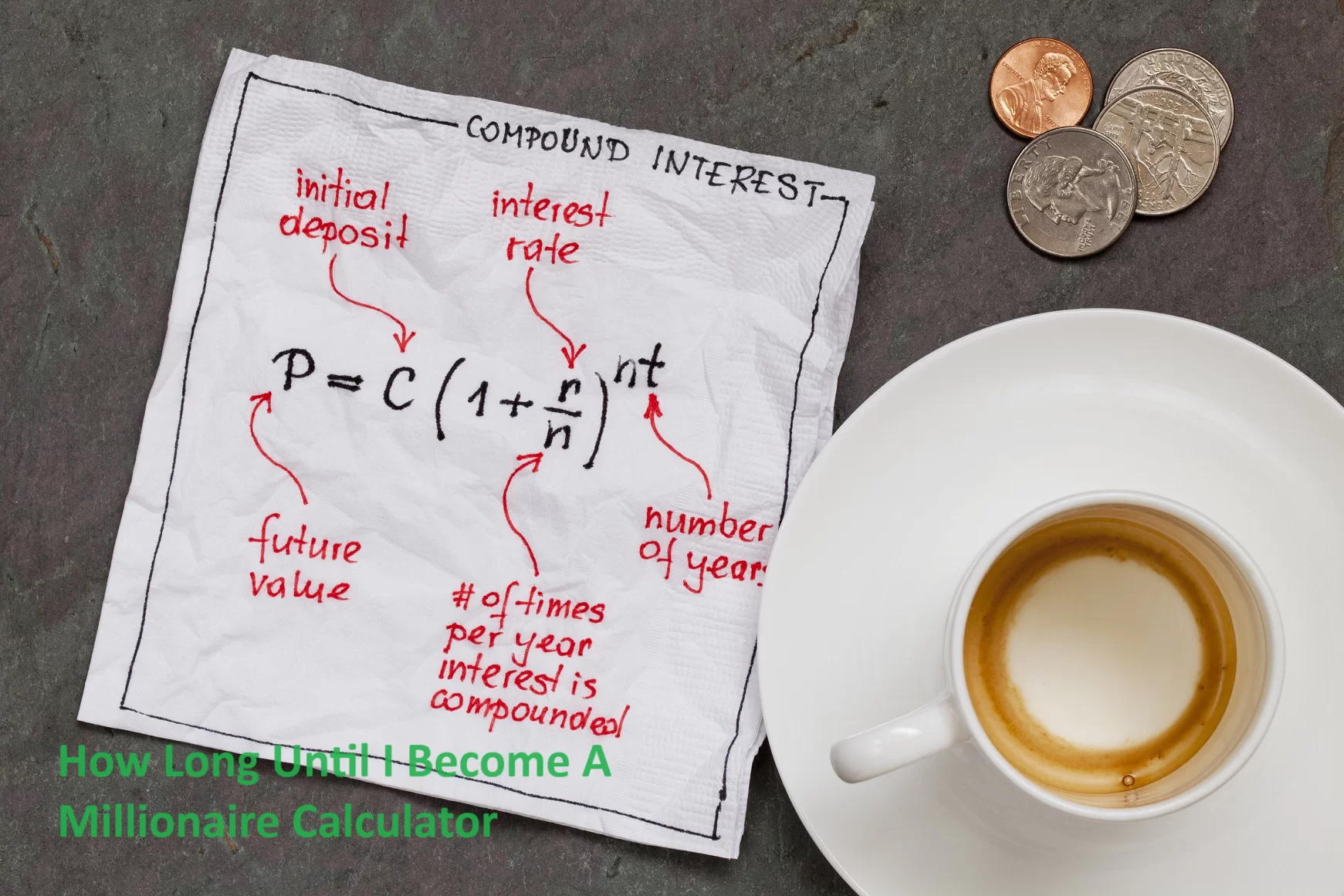

This code takes your initial balance, monthly contributions, and annual interest rate as input and calculates how many years it will take for you to reach a million-dollar balance. You can customize the initial values based on your financial situation.

Please note that this is a simplified calculator and doesn’t account for various real-world factors such as taxes, inflation, or variable interest rates. For a more precise estimate, it’s recommended to consult with a financial advisor or use a comprehensive financial planning tool. A good approach would be to run multiple scenarios.

Millionaire Terms & Definitions

- Savings – This is the amount of money you have saved and currently have onhand to invest. This could be the balance in your savings account or your retirement accounts. The main idea is it is the starting point for the calculations

- Monthly Addition – This is the average amount of the deposit you’ll contribute to growing your wealth.

- Annual Interest Rate – This is the rate of return you expect to get on your money.

- Annual Inflation Rate – This the rate of increase of prices on an annual basis.

- Net Present Value – This is how much your money will actually be worth after you factor in inflation.

Also, this “how long to become a millionaire” calculator is really only for people who are perusing a saving and investing strategy to becoming a millionaire. There are many other ways to get past the 7 figure mark, including suing someone and taking their fortune, marrying well, becoming a CEO and growing a company well, or you could find a rising superstar (such as a politician or sports star) and rise their coattails.

How Long To Become A Millionaire Calculator – Real World Behavior of Millionaires

If you are using the “how long to become a millionaire” calculator and you’re following a saving and investing strategy, here are some scientifically identified factors that should help you build your wealth.

1. Wealthy people are self-aware of their habits. They think objectively about their own behavior and focus on altering and optimizing their own habits. For example, if some of their habits aren’t serving them, they’ll try something different that does.

2. Millionaires tent to set goals. Not only do they set goals, they often set daily, monthly, annual and long-term goals. These goals are almost always tied to a broader vision or dream.

3. The wealthy almost always read. The read consistently on technical topics that help them build skills or skill related knowledge.

4. Wealthy people are healthier than the non-wealthy. This is because they exercise consistently – usually some form of aerobic exercise for at least 30 minutes a day. This allows them to manage stress, work longer hours and stimulates their brain health.

5. The rich are purposeful about managing their relationships. This is because strong relationships are how the wealthy access knowledge, opportunities and capital. They usually maintain relationships by picking up the phone or by firing up email. The rich also intentionally remove toxic relationships from their lives.

6. The wealthy generally live in moderation. They usually avoid overeating and play in moderation as well.

7. Rich people are organized – they create daily to-do lists which are related to their goals and dreams.

8. Millionaires are generally positive thinkers. This means they are upbeat and focused on growth, achievement and self improvement.

9. The wealthy consistently save about 10 to 20% of their income and live off the remaining 80% to 90%. They are also smart about investing their savings, which can grow their wealth.

10. Millionaires control their thoughts and emotions. This helps them manage their relationships. People prefer to do business with people who are emotionally stable.

The main idea here is that calculators are just mathematical tools that allow you to estimate the duration of time any particular course of action will require to achieve millionaire status. For example, its useful if you decided you wanted to cut back on junk food and instead invest the $20 you saved on a monthly basis. The main thing is that the underlying behavior and the choice surrounding it are what really count.

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.