Motley Fool Stock Advisor: Join now for 50% Off!

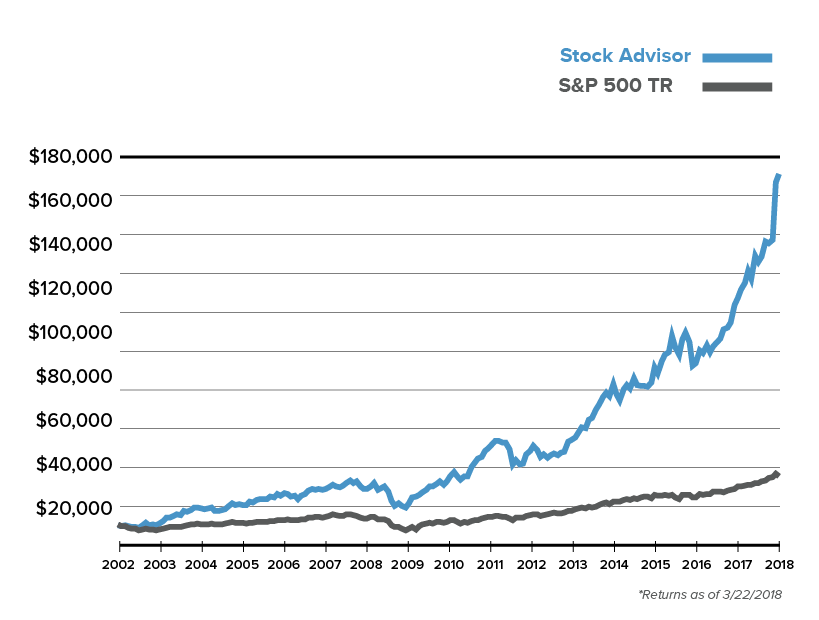

Motley Fool Stock Picks Have Strong Returns

Motley Fool stock picks have more than tripled that of the S&P 500 since its start in 2012. So, if the average investor had been using their stock picks since the newsletter started, they would have made three times their annual return.

Let’s take a look at some of the Motley Fool picks and how they did.

- Amazon is up more than 10,964% since being picked.

- Netflix is up more than 20,960%

- Disney is up more than 5,500%

Amazon, Netflix and Disney are the big winners, but the overall performance of Motley Fool stock picks are pretty good. Motley Fool Services can help you pick out the best stocks that might offer you great returns.

What’s Driving the Returns?

Actually – Motley Fool stock picks are rooted in a hybrid fundamentals and value investing perspective. The Motley Fool Stock Picking team is led by founders David and Tom Gardner. David and Tom use common sense approaches based on modified growth and value investing perspectives.

Team David’s Growth Approach

Team David looks for companies that are not only poised to benefit from “undeniable, long-term trends” but also have a certain level of “unquantifiable greatness” — that is, some sort of secret sauce that gives them an edge and often consequentially wins the love of consumers. David also wants to be able to get in early on these great businesses and has no problem adding to his positions as they keep winning over the long term.

Team Tom’s Value-Based Approach

Team Tom looks first for great companies operating in beaten-down (but still relevant) industries. He also seeks those with strong financials and a proven business model, as well as a shareholder-friendly management team. Signs of the latter often include high levels of insider ownership and reasonable compensation structures.

Source: Fool.com

The Motley Fool Uses Sound Principles

Readers should note this is very similar to approaches used by famous investors like Peter Lynch and Warren Buffet. The Fool team then adds data about emerging trends and recent news developments, and factors in various principles. These include:

- Viewing business as groups of people that make things or provide services, not just ticker symbols that move around computer screens.

- A buy and hold perspective. The Motley Fool takes a long term investing view.

- The need for diversification to maximize returns and minimize losses.

- Independent thought. The Motley Fool is privately owned, so they are able to reach independent judgments that other companies may not.

- Transparency and accountability. The results of Motley Fool picks are available all the way to back to 2002. The Motley Fool also requires ALL staff to disclose their stock holdings.

- Rationality. The Motley Fool’s selection process seeks to remove as much emotion as possible from the investing decision.

The emphasis on diversification, long term holding instead of trading and transparency are important. They allow The Motley Fool to minimize fluctuations in stock prices as well as force discipline into their selection process.

So, the Motley Fool picks are doing pretty well. What’s the value of their newsletter for investors? It turns out, a lot.

What The Motley Fool Stock Advisor Gets You

First, you get a ton of stock picks. This includes a couple of stock recommendations mailed to you every month, monthly selections called their “best buys now,” recommended starter stocks and ongoing coverage of recommended stocks.

But, the value isn’t just in the Motley Fool’s picks. Rather, it’s in the community that comes along with it. The Motley Fool community includes:

- Access to their stock forums.

- Access to their community, including the chance to email and share ideas with their senior equity analysts.

While stock communities might be a dime a dozen on Facebook, Motley Fool’s community is very active. More importantly, it is comprised of people focused on and willing to pay to get get the maximum return on their stock investment. This means it’s almost certainly better quality than most of the other online communities out there.

For serious investors, the community is a time saver and a value add. Motley Fool essentially does the research for you. Most individuals can’t dedicate the time or energy necessary to make high-quality picks on their own. That leads many investors to underperform, in comparison to index benchmarks.

Further, the community access is an important check against investing mistakes. Occasionally, abandoning a particular investment is wise, such as when a negative incident means a company won’t recover. Pending corruption or money laundering charges may be a sign that bailing out is the right move. In some cases, this stuff doesn’t make the mainstream news; you won’t know unless you “hang out” with people who are observant and paying attention.

Stock Newsletters Aren’t A Silver Bullet

As great as any particular newsletter is, you’ll still need to follow investing best practices. This means diversification, keeping your expenses low, rebalancing your portfolio and keeping an eye on your holdings.

How you diversify is ultimately up to you. However, newsletters like the Motley Fool Stock Advisor are just about stocks. They don’t look at other investment options like mutual funds, real estate, exchange traded funds or bonds. They also say nothing about healthy personal finance habits like saving 10% of your income or owning your own home.

It’s a stock picking service for people who want to try their hand at beating the markets — that’s it.

Our Conclusion

The Motley Fool Stock Advisor is an excellent value for moderate to experienced investors who want help maximizing their returns. At $199 per year, the service offers stock investing choices based on a disciplined perspective. The subscription allows you to directly access the Fool investing community, which is an important value add. They’re offering a 50% off right now, so you can always sign up and cancel after a couple of weeks if you aren’t a fan. Get it at the link below:

Motley Fool Stock Advisor: 3X the Stock Market!

Here is a handy video describing the service and the Motley Fool stock picks approach.

Disclosure: The links in this article are affiliate links. Thousandaire.com will earn a commission if you click through and get the Motley Fool Stock Advisor. Thousandaire is independently owned and the viewpoint expressed here is entirely our own.

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.