At the beginning of this year I decided to start a little experiment with the stock market.

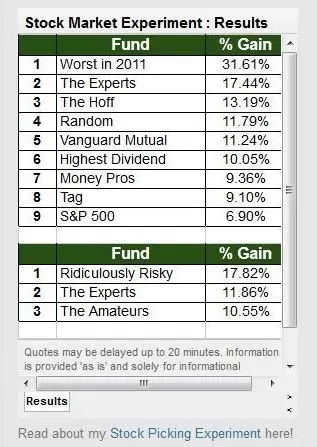

I wanted to see how well some financial experts and the S&P 500 did against the stock picks of complete amateurs, as well as some very risky (or even random) stock choices. I’m tracking nine different “indexes” and if you’re really curious to follow along with the progress, you’ll notice I have a leaderboard that updates in real time on the sidebar.

Well it’s been over a month and I wanted to revisit some of those picks and take a look at what is happening.

To see the full performance details of every stock picked in this experiment, click here.

I’m Kicking the S&P 500’s Butt!!!

If you hadn’t heard very few professional fund managers are able to beat the market. Considering how hard it is to beat the market, I am absolutely shocked that I’m not just beating the S&P in all 8 of my choices, but I’m beating the S&P by a minimum of 2.2% in all of them.

If you hadn’t heard very few professional fund managers are able to beat the market. Considering how hard it is to beat the market, I am absolutely shocked that I’m not just beating the S&P in all 8 of my choices, but I’m beating the S&P by a minimum of 2.2% in all of them.

We’ll see if this holds for the rest of the year (highly unlikely) but it does show that you don’t have to be an expert to beat the market in the short term.

31.61%? That Can’t Be Real!

Most finance professionals suggest you expect something like a 7-8% annual return on your investments. The Worst in 2011, which is just the 10 companies in the S&P 500 that lost the most value last year, has gotten over 30% in just over a month! This is one of my favorite theories of investing. If the price dips on a good company (which most companies in the S&P are pretty good), it’s on sale so buy it!

If I actually owned these stocks, I don’t even know what I would do. Do you sell and lock in your 31% gain, or do you hold for more? I would want to sell, but I would probably hold and see what happens.

The biggest gainer so far is Netflix (NFLX) at an 86% gain since December 30th. 86%!? You can go a decade and not have a cumulative 86% return on a decent performing stock. All ten stocks are positive, and nine of them are above 15% on the year. Cablevision (CVC) is pulling up the rear with only a 4.85% gain.

Random vs. Vanguard Mutual Fund

In what is probably my favorite result so far, a random selection of stocks is not only almost double the S&P 500, but it is beating a Vanguard Mutual Fund that was supposed to be a great performer this year. The main point of this exercise is to determine how well a random selection of stocks can do against “experts”, which makes the Random vs. Vanguard the most important comparison. And I like to see random winning.

One Month Anomaly, or Real Trend

What boat are you in? Do you think the Vanguard fund and the S&P are going to end up on top, or can Random and Worst in 2011 hold on over the course of the year?

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

The best time to buy is when the economy is crappy. Everything is dirt cheap!

If you have the money to do it, then I agree!

I would sell every last NFLX and SHLD share I owned. Sears is going bankrupt, end of story. Netflix will have to learn that not everyone can be a marginal cost consumer. (Also, Redbox signed a JV with Verizon yesterday that might develop into a real Netflix challenger by 2Q!)

As for the financials, I don’t have any real exposure to banks nor do I really know what I’d do if I held them. Banks sell a relative commodity, so there’s no long run durable competitive advantage in that space.

I think the worst in 2011 will end up on top in 2012, by a much larger margin than it is today. I’m determined to win that MoneyPros index challenge!

I’m glad you noticed that you might not be able to do it over the course of the year. It seems like everything is up right now, so everything is bloated. And one stock can really carry the load. I’m up 25% with BAC, but that’s just not normal for a year, let alone a few months.

Have you looked at previous years to see where you would have ranked? We’re talking about VERY small time periods in the past month and a half, where one small change can make a humongous difference. If they always overperform, I expect you to start a fund and sign me up!

How easy would it be to figure out the biggest losers over the past 12 months rather than just in the calendar year 2011? You could buy/sell at the end of each month or quarter so that you’re always holding the latest losers ripe for gains.

I’m doing well in my portfolio vs the S&P also. I do keep reminding myself, that this is a marathon and not a sprint, so I better not get cocky!

Sell or hold at 31%? depends on the stock. If they are high beta, risky stocks, sell, wait for them to fall, and rebuy (or buy something else with the proceeds). If you get those gains in the market overall because you are in for the long haul, it does little good to sell and put it somewhere else, because the rest of the makret has been going up too. — remember Jan was a good month for a lot of people. my networth went up by more than I made in the month, so I guess I was living free for 31 days. Im expecting a correction, but Im not setting.

It’s interesting that you mention these excessive gains that have been realized in the beginning of this year. I’m currently writing a thesis about this phenomenon and a lot of literature is pointing to two reasons for this sudden upswing. The first reason would be something called the ‘January Effect.’ The main idea behind the January Effect is that the tax-loss selling that occurs in December reduces the share price of securities that have been ‘losers’ during the year. Investors sell these ‘losers’ to offset the gains they have realized so that they have a lower tax bill. January presents a buying opportunity for these same ‘losers’ and a sudden price increase comes about as a result. Historically, January gains have typically been higher than any other month of the year.

The second reason is the Fed’s recent announcement to keep interest rates low for the next couple of years. Bernanke wants American investors to place their money into equities as opposed to bonds and CDs and this low interest rate environment is essentially forcing folks to do just this. Again, this works to inflate share prices as a result.

Also worth noting is that the January Effect is far more prevalent in small- and mid-cap stocks than their large cap counterparts. Do most of your picks fall in these categories?