I’ve been updating my Race to $1 Million for about 18 months now. And before I focus on this month’s results (which are awesome), I want to spend a few minutes reflecting on how far I’ve come in the last 18 months.

I first introduced the competition on September 22nd, 2010. My blog was so popular at that point I got exactly four comments on that post. One from The Hoff, one from my girlfriend TAG, and two from myself. Woohoo!!!!

At that point, I said my net worth was only about $5,000. It was actually $6,569.98. Here are some other facts about my financial life back then:

- I had over $23k in student loan debt

- My retirement accounts (401k and Roth IRA) combined for about $18,500

- I had a lot less gray hairs back then

Now let’s look at my financial situation today

- I have under $8k in student loan debt ($15k better)

- My retirement accounts combine for about $34,000 ($17.5k better)

- I have so many gray hairs I’m thinking about dying my hair. I’m only 26!

I’ve made a lot of progress over the last 18 months. In fact, I’ve made $35k worth of progress in my personal net worth. Here are the results for March 2012:

Over $14,000 in One Month!!!!

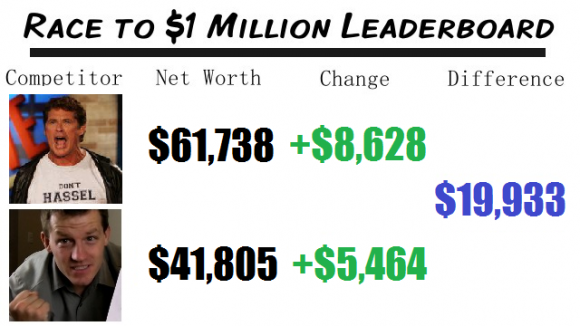

Usually I like to talk about how badly I beat The Hoff, but since he beat me this month I want to talk about how incredible February was for both of us. We increased our combined net worth by over $14,000 in 28 days. That’s $500 a day!

This is a competition and I want to beat the snot out of The Hoff, but I can’t help but sit back and marvel at how well we both did in February. When I go up over $5k in one month, I consider that a win no matter what The Hoff does. When he goes up $8k in one month, he probably sings “Money” by Pink Floyd in German.

Next Month Could Be Better!

There are two huge items coming down the pipe in March for both of us. We work at the same company, and our company gives us our 401k match for all of 2011 at the end of March. That is going to be about $4,500 for each of us.

We are also going to get our tax refunds in March. I have already filed my taxes and will be getting a little over $1,000 back any day now. The Hoff told me he’s looking at over $2k.

I won’t be surprised if The Hoff breaks $70,000 for our next update. I just hope I can keep pace!

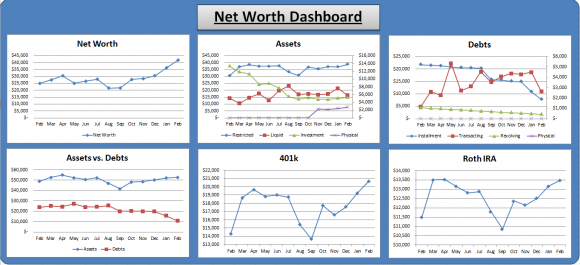

My Net Worth Tracking

As always, here are the net worth tracking graphs I use in my customized Net Worth Tracking Spreadsheet that is free to download. Once again you’ll see a big drop in my student loans after paying off another big loan.

By the end of the year I hope to pull even with The Hoff and show a big fat ZERO in the student loan line (blue installment line in the debt graph). Again, wish me luck!

Carnival Links

Carnival of Money Pros at Money Pros

Yakezie Carnival at Not Made of Money

Carnival of Financial Camaraderie at My University Money

Canadian Finance Carnival at Canadian Finance Blog

Carnival of Retirement at Money Reasons

Financial Carnival for Young Adults at 20’s Finances

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Woo! February was an amazing month for you guys, with its 29 days, not 28 this year 😉

Why does your employer only give you your 401(k) match in March of every year?

I thought the Hoff was planning a wedding? Surely that $2k will help with that!

P.S. I hope your mom is doing better.

I think our employer does the match in March of the next year so that when people leave the company, they don’t get the match. Our 401k is fully vested immediately so as soon as the match hits our 401k, it’s ours to keep.

Good catch on the 29 days. I’m dumb.

My mom is doing alright. Her first chemo session is tomorrow.

Does that make it qualify as a Safe Harbor plan?

Mine takes 3 years to be fully vested, but at least it has the ability to grow throughout the year. If you max out your 401(k) early in the year, then my employer will give you the remainder of your match at the end of March, so your March timing makes sense to me.

Haha, you’re not dumb – you were just excited about how well your February went! 🙂

I don’t know exactly why they do it that way. All I know is that if I ever decide to leave the company, I’m probably going to do it on an April 1st.

Depending on entity type, type of plan, type of employer contribution (safe harbor, discretionary match, profit share), could dictate when employer contributions are required to be made. General rule is by due date of their tax return (plus extensions). Since most companies are required to file by March 15th it sounds like your employer likes to keep the money to the last second. 🙂

They fund the 15th of march and it hits your account a week or so later.

cool blog, found out about it by P.D.I.T.F.

Wow Kevin all I can say is Great Job! Keep this up you’ll be hitting that big M in 10 years or less!

Keep up the good work. The markets have been kind to start 2012. However, March is looking a bit choppy. Let’s see how we do when the rising tide is not lifting all boats.