I hate Social Security.

I hate that it takes 6.2% of every dollar I earn (temporarily 4.2%), and takes 6.2% of my income from my employer (who would probably be paying me that extra 6.2% if they weren’t paying it to the government!).

Imagine how much more I could save for my own retirement if I had a 12.4% raise. That’s $3,720 for someone making $30k a year. That’s $6,200 a year for someone making $50k a year.

And finally, even though I hate any kind of tax or benefit that isn’t flat, this on is especially insidious. Social Security is an incredibly racially and socio-economically regressive tax. The tax helps rich white people way more than it helps middle class and poor minorities.

Race Matters

The full retirement age for social security is 65-67, depending on when you were born. When you consider that white men live to be 75.3 years old on average and black men live to be only 70.8 years old it doesn’t look so good. The average white man gets 8.3 years of benefits while the average black man gets only 3.8 years of benefits.

Let me say that again. The average black man pays 12.4% in taxes on his annual income for 40+ years, and in return gets less than 4 years of Social Security benefits which are so crappy he’ll probably need a part time job anyway.

Similarly, a white woman lives to 81.2 on average, while a black woman lives to 77.5, giving the white woman an extra 3.7 years of benefits.

Source of average ages can be found here.

Income Matters

Not only are white people getting the most benefit from Social Security, but rich people also live longer than poor people, which means the rich get much more out of Social Security than the poor.

I couldn’t find more recent data, but what I did find shows the top 50% of 60 year old earners in America live to an average age of 85.4 years, while the bottom half live to an average age of 79.6. If anyone knows of more recent data please post in the comments.

This should be no surprise: rich people live in safer communities, can afford healthier food, have more leisure time and can afford better health care. Don’t get me wrong; if you’ve worked hard and made a bunch of money then you deserve those benefits. I don’t think rich people deserve a big Social Security check paid for by hardworking (and potentially poor) Americans.

Think about this for a minute. A rich person who probably doesn’t even need supplemental income during retirement is going to get many more years of Social Security benefits than a poor person. This is truly disturbing when we look closer.

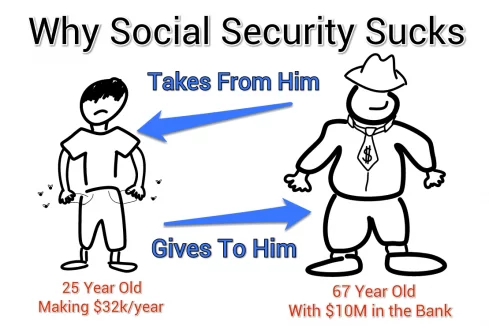

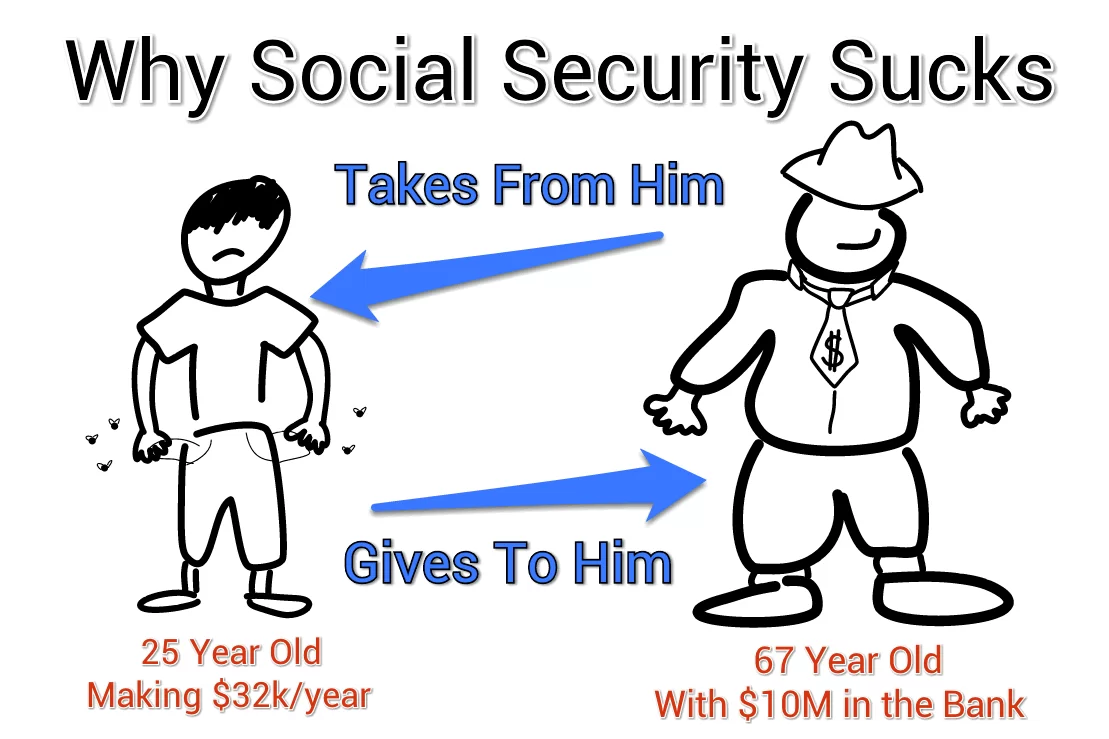

Remember that Social Security is broke and today’s benefits are funded by today’s Social Security taxes. That means someone making $10 an hour today is paying Social Security taxes, some of which are going directly to rich retired people who have millions of dollars in the bank. Social Security is taking money from poor working people and giving it to rich retired people. I don’t care who you are or what you believe; that’s not right.

It’s time we stop pretending that Social Security can work as a retirement plan for the elderly. People who can afford to pay for their retirement should stop receiving benefits immediately, and those who can’t should be migrated into existing welfare programs.

What This Means For You

If you are a young person like me, I recommend that you start saving for retirement under the assumption that social security won’t be there to help. As for all that money you’ve already paid in; just consider it another tax from your friendly neighborhood Uncle Sam.

If you are nearing retirement and you are expecting Social Security, I’d recommend doing whatever you can to extend your career and save up money, because Social Security is going to collapse if it isn’t ended voluntarily.

Finally, if you are currently receiving Social Security then enjoy it while you can. I don’t think it’ll last much longer, and I hope you have a backup financial plan.

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

It’s broken for sure, but really? People who make more, put more into it. I think that poor people get way more out of it (proportionally) than rich people. It’s a pay-it-forward system, so deal with it. Also, the black/white thing is a ridiculous argument.

How do poor people get more out of it if they aren’t living long enough to reap the benefits. People who live a very long time can actually get more than they put in. People who die in their 70s will never get more than they put it.

Also, people who make more also get more benefits. Plus the social security tax stops at a certain income level (around $110,000) so the very wealthy still only pay social security on the first $110k or so of their income.

I think you make GREAT points!! I hate Social Security too, and like you said, I’m just planning for my retirement based on the assumption that I won’t be getting any benefits from it. Pretty lame though.

@Brad,

It’s not a ridiculous argument. Not when life expectancies are disproportional.

It’s definitely true that the rich benefit from SS more as they only pay taxes on the first $110K. Then they “enjoy” benefits longer.

I have a great plan for fixing SS. It needs to become the safety net it was intended to become:

Mine is a hybrid government/private plan.

Everyone is required to invest 8% of their income before taxes, matched 100% by their employer and invested into a private account at a low cost, government created investment firm (or have a competition between firms in the private sector like Vanguard and Fidelity, or give people the option to choose). There will only be 3 low cost investment options based on risk: High, Medium and Low. Once you reach 40, if you have any high risk investments, it’s converted to medium, and at age 55, any medium is converted to low. This minimizes any impact stock market fluctuations have on older folks’ accounts. On top of that investment, they are taxed 2% (again matched) that goes into the SS general fund (invested in treasury bonds). A .025% annual fee will cover the expenses and salaries of the government investment fund.

The new SS administration, each year, sets the minimum retirement age (75 or higher) and minimum retirement account balance. If, when you retire, do not meet the minimum, you will receive the difference from the SS general fund.

At the time this new plan is enacted, anyone over 35 will get the same SS plan as today. Anyone under 35 who has already started contributing to current SS will get both and new workers will get the new plan.

In order to maintain current SS plan distributions, everyone will be taxed 4% for the first 5 years, 3% for the next 5 and so on until it reaches 0. By that time, all current plan participants will be dead or close to it.

I can’t believe no one else commented on this… I love your idea!

This plan doesn’t account for the “age/race discrimination” that Kevin alledges. Nor does it fix the plan of people paying into a system that they won’t reap much benefit from, if Kevin’s mortality rate accusations are correct–you’re raising the retirement age to 75.

Your data really points out the women are the true beneficiaries, black or white. Where’s the outrage about the sexism?

I believe we should not have social security at all. In fact, I would be willing to stop paying into it today if were allowed 🙂

It’s really frustrating, isn’t it? I’m 30 years old, I’m fairly certain that Social Security is not going to exist by the time I can utilize it, but (like Kevin says), all I can do is consider my paycheck deductions to be an involuntary charitable donation to the retired.

I wish the government would at least acknowledge that people under a certain age are not going to reap the benefits of Social Security, and just re-name the deduction and let us write it off. Or let us put in less. Something!!!

I disagree with your premise that social security is a waste of savings for low income persons. You also act like if you had that extra money in your paycheck, then you would save more. Well you personally may save more, but the average American will not. Look at at the average retirement account balances of employees 50+. They are no where near where they need to be. The self governed IRA and 401k plans have failed miserably as retirement vehicles and will leave more people dependent on social security for their retirement. Corporations have cut pensions to save money and are now cutting out the employee match, leaving the employee responsible for their own retirement. As the dismal retirement balances illustrate, Americans are incapable of saving on their own. If anything social security needs to be increased and the payouts at least doubled in order to provide for the future generations that will have nothing in retirement. Either way taxpayers will end up paying for the incompetent saver’s retirement. Forced savings through taxation is the best way to combat this failure of the pension/personal retirement accounts.

I totally agree with this comment: majority of US citizen are real sucker when it comes to saving.

Yesterday I had such a good laugh on linkedin: I found the profile of the wife we bought their house, from her job, she is making probably in the 80$ year range, and I think the husband was the money maker, so they have at least the double of that. In the seven years they live in their house, they paid only 46k$!!!! they still owned the remaining to the lender!!! yes including initial money!

assuming that they had no initial money (ok I know the bare minimum is 3%), they repaid each year: 6500$

Now, look at that 6500/160000= 4.1%

It means that they ware able to only put 4.1% of they ~160k$ to pay for their house they lived in!!!

And you want them to save for something in 40 years?????

And they are white collar BS educated making good money?????

the decline of the empire is soon.

I agree 100% with you, most of american nowadays have no clues about domestic finances. See real life example:

Yesterday I had such a good laugh on linkedin: I found the profile of the wife we bought their house, from her job, she is making probably in the 80$ year range, and I think the husband was the money maker, so they have at least the double of that. In the seven years they live in their house, they paid only 46k$!!!! they still owned the remaining to the lender!!! yes including initial money!

assuming that they had no initial money (ok I know the bare minimum is 3%), they repaid each year: 6500$

Now, look at that 6500/160000= 4.1%

It means that they ware able to only put 4.1% of they ~160k$ to pay for their house they lived in!!!

And you want them to save for something in 40 years?????

And they are white collar BS educated making good money?????

the decline of the empire is soon.

I agree with Brandy. I would rather invest that money myself. I’m all for privatizing SS, one less thing the government has control over would be awesome. The only problem if they privatized it would be that some people would just spend the money now, instead of saving it for retirement.

Apparently I am the only one who think SS will be around for a long time. Like it or not, SS will continue to exist as long as politicians want to get re-elected. None of them have the guts to kill the progam or really overhaul it, so they will just keep raising the retirement age or possible go to a means test system.

Means testing scares me, because it penalizes savers. Why should someone pay into a system, with the PROMISE of a payout and then be told, “I’m sorry you saved to much and SOandSO didn’t so we are going to pay them and nto you.” I know the world isn’t fair, but at the very least you should get what you paid for…

Social Security had the potential to be around for a while if politicians actually saved money in the social security trust fund. Unfortunately, that money was spent and replaced with government IOUs.

Social Security benefits are higher than revenue, and they have $0 saved up to meet the shortfall. It’s a Ponzi scheme that’s reached unsustainability. I don’t see how it can exist much longer, not to mention another 40 years until I retire.

Social security is not a ponzi scheme, I thought only Rick Perry believed that.

I think you’re overreacting, only small changes need to be made to make it last a lot longer. As it is, social security will run as is until 2036, and then if nothing changes, 75% of benefits would be paid out. But I’m sure that some small changes will be made, like reducing cost of living increases, to help cover the difference.

I don’t think it’s a perfect system by any means and I’d definitely like to have control over my money (I would love to opt out). But there’s no real crisis here.

FWIW, the Social Security trust assets will run out in 2036, but each draw on that account is essentially new US debt issuance. Granted, the national debt will not go up until 2036 because of SS (we already account for it by SS owning US debt), but there will be more US debt on the public markets. It does have an effect, even if we already papered over it.

Someone has to buy what the SS Trust will have to sell – US government paper.

Actually, if you consider that an individual is receiving more in retirement than they had put in each month when they were working (and I see Social Security benefit amounts all day at work…they ARE), that means it takes multiple workers’ contributions now to pay back one individual on the level above’s “investment.” Very much a pyramid/ponzi.

True, if SS is only funded by what SS brings in. There is nothing that says in the future or now that it can’t be funded by other streams of income, i.e. special tax to address shortfalls. I don’t see SS going away, it could be fixed very quickly, and we are not even at a crisis point yet. Take the amount spent in one year in Iraq/Afghanistan, and you have the problem solved. We didn’t plan to spend that money, but somehow found it when it was needed.

I personally would rather.invest it myself as well but I doubt employers would give you a raise if they stopped employer contributions tomorrow. They would just pocket it and increase their earnings or maybe bump up their retirement plan match.

To add to this, the age of retirement (65) has been in place since the 1930’s when the average person didn’t live to see retirement age. It’s held at 65 while life expectancy has improved dramatically to this point today when retirement is almost considered a human right. Of course it is not, retirement age should have risen with life expectancy but try doing that now with the huge baby boomer population swaying the vote in their favor.

Now us young people will be stuck with the tab. Not to say that the baby boomers are the only demographic that fails to save, but they are the largest and the group that will cripple social security / pension.

I think people should have the right to opt-out and save themselves. Of course most people would opt-out but If they choose to not save for retirement, not my problem.

I am 5 years away (at 70 y. o.) from collecting Social Security . The more money you earn in retirement means almost all of it will be taxed. One of the problems of Social Security is it is political and Congress keeps using the pool of money for other things.

Yeah, that’s my biggest grip too! They (Congress) use the money we channel in for other things, then we wonder why we don’t have enough money in the system… Well Duh!

That said without Social Security, I personally know a lot of white and black folks that would be living on the street. It might not be much but to them it’s the difference between suffering and living a respectable live…

Do I hate Social Security?

Sure, I’d much rather keep my money and do with it what I want to do, but it does help others that are less financially savvy than I am (and the majority of the bloggers on this site)…

Wow, everybody take a step back and breath slowly before this thing really blows up. America’s obesity rate will probably wind up saving the day, as most American’s will not make it to an age to collect anything….

My advice is to know the rules of the game, that way you are in the best position to win. I don’t think the system is either racist, sexist, fatist or elitist. It is simply a system, just like the tax system…play within the rules for your own personal best outcome. Use it as one leg to support your retirement table. The more legs you have, the more stable your retirement will be. Unfortunately, SS, is the only leg under that table for something like 90% of the Country.

Not before our moneys go to the medical bills of the obese and their diabetes, joint transplants and stomach staples.

Not before our money goes to the medical bills of the obese and their diabetes, joint transplants and stomach staples.

I don’t really buy that arguement. I think SS is a waste of my money. I also hate being FORCED to pay a tax on something that is completely useless to me. The only reason I can even look at that stupid tax on my paystub every month is because I feel bad for my parents, their parents, and all the other people retiring who have paid it all their lives with the pipe dream that government will take care of them. Of course, they had no choice in the matter. I am tired of politicians promising the moon and delivering short. I believe that people (my generation) should start taking personal responsibility for their lives. Government will not always take care of you. They will disappoint you. Unfortunately, Gen Y happens to be one of the LEAST personally responsible of all recent generations. It’s such a shame. The only thing I can do is look out for me and my own at this point in time and let the wolves take the sheep out to pasture.

The poor may get a better annual return on their tax dollars from Social Security than middle and upper income individuals. Maybe the poor dying sooner evens that out? It matters not, because it’s a social program, not an investment product.

I see it as a bit of insurance should I fall on hard times or take a huge hit to my personal investments. My tax money also goes to pay for roads I may never drive on, food stamps I may never get, and police who may never save my life. In order for social goods to work, everyone has to pay in now and accept that some will benefit more than others.

With that said, I think SS could very well fail and I really don’t like paying into a system that is inefficient and dying. I think if a genuine effort is not made to make SS work on its own, society will be worse off keeping it going than if we just start phasing it out. I like the principle behind SS, but I hate paying into it because I feel like I’m forced to pay into a doomed system.

That tax money should go to pay SS. So I’ll walk, I’ll work, and utilize my CCL.

I think that Social Security is an example of a program that was a good idea but was executed very poorly. As another commenter pointed it out, it was designed around the idea that most people wouldn’t live to reap the benefits and has failed to evolve over time.

Your point is well taken about the poor benefitting less from SS benefits than the wealthy, but it fails to take into account some of the other struggles facing the poor, including lack of education about financial matters. For many poor Americans, due to lack of both financial and educational resources, SS is the only retirement plan that they have. In order to solve that problem, we need an overhaul of a lot of other government spending programs (and the tax code) to provide those resources.

On another note, I think that in the next 25 years Americans will be facing a retirement crisis – something like half of Americans have not personal retirement savings. There’s going to have to be some kind of change to either SS or employer funding of retirement so that we don’t end up a country of impoverished elderly.

Sorry, but this is a pretty silly theory.Race has nothing do with it. You happen to have a shorter life expectancy? Make changes to your life which will add years. Easy. And white people die younger than the life expectancy all the time. Remember average life expectancy does not equal median life expectancy.

I’m guessing it would be more fair for the “rich white man” to pay in while the “poor black man” doesn’t and then the poor black man receives the check while the rich white man lives off his own invested money. Sounds a lot like food stamps, or welfare, or section 8 or government assistance to pay for electricity and water bills. There is always disparity. You want utopia?…good luck with that.

Kevin, you’re crazy. lol. I hope you really don’t believe this Freakonomic theory. A + B = A + B. It’s not A + B = AB.

If you would have claimed that SS benefits rich white people more than other races then, sure, you would have a leg to stand on, given the date you provided. But the way you wrote this suggests that there is some underlying scheme to tax poor people only to the extent that it will benefit rich white people. Those two thoughts are not the same argument at all.

It just so happens that the mortality rate for black folks is higher. My dad worked for 30 years and he’s collecting a pretty penny. Not to mention, social security also pays those you are minors of senior citizens. Can’t we make the argument that black folks have more kids so once they reach the age of SS eligibility they’ll have more kids collecting until the age of 18, or until they are out of college?

You know me well enough to know that I want to eliminate all federal involvement in welfare, retirement, and medicine on principle.

I was just pointing out the fact that social security taxes working people (including the working poor) and gives to non-working people (including the rich retired people).

I also understand that social security taxes the working rich and gives to the retired poor. My point is that we can’t afford social security anymore. We need to drastically cut back the benefits (and hopefully eliminate the program altogether). The best place to start in my opinion is to stop paying benefits to people who don’t need them. When we can end the program entirely, the retired poor will still need benefits, and they will get them from state governments and/or private charities.

We didn’t have elderly dying in the streets before social security, and we wouldn’t have it if we ended the program. America is a country full of prosperous, generous people who will help people when it’s necessary.

I agree with you that young people should invest lke there will be no soical security. I also hate social security and wish the government would let me opt out right now.

However, you cannot use average life expectancy as a method of saying that rich white men and women make more in SS than their black counterparts. You MAY be correct in saying this, but your reasoning still contains a glaring falacy:

I don’t have any exact numbers, but it could be that less whites die early (in their teens through fiftys) than blacks. This would mean that blacks would then live on average shorter lives since more are dying younger. Again, I don’t know if this is true, but it does demonstrate a posible problem with your reasoning.

To prove what you are saying is true, (and it may or may not be, I don’t know), you will need to compare the average remaining life expectancy of a white man/woman that makes it to 65 vs the average remaining life expectancy of a black man/woman that makes it to 65. It could be (although I doubt it) that blacks that live to be 65 actually outlive their white counterparts, meaning that they would get more from SS – and this fact would still be consistant with shorter overall life expectancy for blacks vs whites.

I don’t know about this… Black people… white people…. average life span. It all seems a little cheesy to me. According to the study I’ll post below, Hispanics have the highest life expectancy of people of all races and genders at age 62 (page 35). They’re also quickly changing from a minority to the majority. Why not pick on them? Oh wait, that wouldn’t be as popular because they don’t have a high economic status.

http://www.nber.org/programs/ag/rrc/NB10-11%20Cutler,%20Meara,%20Richards%20Final,%20REVISED.pdf

I agree that social security is a sucky program. However, my grandma (3/4 white, 1/4 american indian) paid into it, and now collects it monthly. She has enough to survive without it easily but guess what… her sisters don’t, so she helps them out a little here and there because she’s able to and she chooses to. I also think you overlook the cost of end of life care and how quickly that can make a retired person’s sizable life savings evaporate. By the way, my grandma has a 6th grade education, she’s never been to Hawaii or New York, let alone out of the country. She has money because she’s saved it. I don’t see where some of you folks get off telling people what they do or don’t deserve for what they’ve worked for and honestly earned. It’s none of your business if she “needs” it!

I’m not expecting anything to be left when I retire, but I’ve known that since I was a kid. This is why I love Cosby so much. He spends his time and influence telling people to stop feeling sorry for themselves and start becoming the person you want to be. This is true for all races. If you don’t like the odds, beat them by pulling yourself up, not dragging others down.

Aren’t rich white people, be definition, contributing more to social security (because they are rich) through their 40 years of working than the average black man? So, they are just getting back what they put in.

Aw, this was a very good post. Spending some time

and actual effort to make a great article but what can I say I put things off a whole lot and

never seem to get nearly anything done.