Back when I used to write about fantasy football, I was always terrified of people reading my old posts. Basically, my job was to predict how well professional football players would perform in their NFL games. I was wrong. Frequently.

If anyone ever decided he didn’t like me, he could just read any one of my old posts and find predictions I made that turned out to be wronger than a mullet on a little baby girl. Awesome side note: “wronger” is a word!!!

Luckily I don’t make many predictions on this site. While it’s possible that I’m wrong sometimes, it would be very hard to actually prove it. The one exception would be stock picks, most of which were made by The Hoff. For the few picks I made, let’s just say that the amount of money I’ve lost in the stock market is way more painful than any ridicule someone might give me for my less than wonderful predictions.

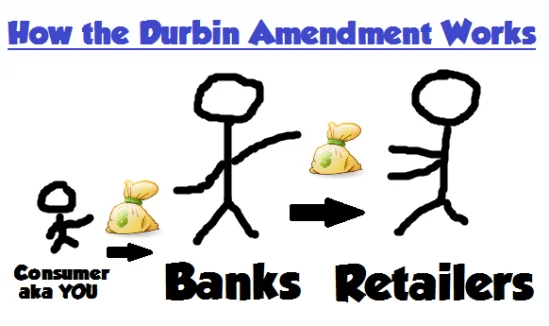

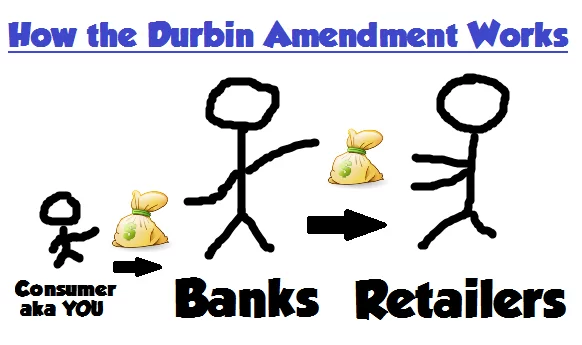

However, I did make one prediction a few months back and I think it’s a good time to revisit whether I was right or wrong. My prediction: The Durbin Amendment would harm consumers while it lines the pockets of business owners.

The Durbin Amendment STOLE Your Rewards

Back in March I wrote about how the Durbin Amendment Wants to Steal Your Rewards. It put a cap on interchange fees for debit card purchases, meaning the banks make less money; therefore, they can’t pass any rewards along to their customers.

It wouldn’t take a genius to figure out that debit card rewards were going to disappear. It’s a pretty logical result. However, just to prove consumers lost this benefit, here are a few examples of debit cards that discontinued rewards programs here and here and here.

The theory behind the legislation was that retailers would pass those savings along to customers. I’ll quote Rachel Wolf in a CNN article I quoted half a year ago:

“Because retail is such a competitive industry, any savings retailers get they are going to pass along to customers, because if you don’t offer competitive prices, someone’s just going to go across the street to the competitor.”

So now that the Durbin Amendment is in place and we’ve all lost our debit card rewards, let me ask my price conscious readers: Have you seen prices drop?

You haven’t? Interesting…

The Durbin Amendment was never about doing what’s right for consumers. It was always about one thing.

The Durbin Amendment Succeeded at Taking Money From Consumers and Giving it to Retailers

Let’s review what happened thanks to the Durbin Amendment

- Consumer rewards from banks for their debit card purchases have been eliminated

- Consumers pay higher banking fees; banks blame Durbin Amendment for fees

- Consumers pay higher prices for retail goods

- Retailers make higher profits thanks to lower interchange fees and higher prices

- Retailers “thank” Dick Durbin and other politicians for doing such a great job at writing laws*

*Organizations like the National Retail Federation and businesses like 7-11 have publicly praised Dick Durbin for this amendment. I’ll let you decide whether or not you think there were any undisclosed monetary “thank you’s” sent his way.

The Durbin Amendment was incredibly successful at taking money from consumers and using it to line the pockets of executives for big retail business.

I’m no genius and I saw this coming a mile away. The politicians who voted for this garbage did it knowing full well that it would result in taking money from average Americans and giving it to business owners.

And there’s no turning back now. If you repeal the amendment, retailers are going to say, “Ahhh!!!! Expensive interchange fees!!! Must raise prices!!!” and banks will pretend like nothing happened (just like the retailers did this time) and decline to pass the savings along to customers.

What happens when the government tries to legislate who wins in a “free market”?

The consumer loses.

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

This is the absolute truth. As an owner, I will simply pass costs on to the consumer knowing that other owners will likely do the same. It is one reason that the rich get richer.

It’s amazing that these politicians can regulate how the economy works. It comes out of a massive sense of arrogance.

Agreed 100%. What the heck happened to the free market?

I asked the same question when the big banks and investment houses got bailed out. WTF happened to free market?

I’m with you on the bailout. I don’t think it should have happened. But how can you say you want a free market when it comes to bailouts, but in the same breath say you want the government to regulate the interchange market? It doesn’t seem very consistent.

Sorry for being unclear about regulation. I’m not an opponent to regulation if crafted efficiency without being a burden. I see interchange invention as a direct reaction to the bailouts. If you want to get bailed out, you have to face some the consequences which is namely more regulation. If the investment houses were not bailed out, we wouldn’t need the interchange regulation in the first place.

You nailed it on this one. Now if you could only predict when your music videos would be done! Ha! :–0

Haha, that’s much harder to predict!

I heard this one many years ago when I was a young thousandaire, “most people become a conservative when they have something to conserve”. I bet Durbin gets free slurpees for life.

Ridiculous. Great post. I laughed…and I almost corrected you on your “wronger” usage—but was shocked to read it IS a word! Crazy funny. Have a Merry Christmas, dude!

“wronger”? Really??? Seriously? 😀

Durbin amendment did exactly what it was supposed to do. Big banks acted irresponsibly prior to the 2008 financial crisis. Power and money needed to be redirected away from the big banks. You saw that small banks and credit unions converted ex-big bank customers to their banks. Shift of power.

As for lower prices in retail, you have to give it time. Since non merchants don’t have a full grasp of how interchange interacts with merchants, there needs to be time for merchants to switch over to payment processors that can offer better pricing. Regardless of the Durbin amendment, merchants are tied in to the contracts they have with payment processors. The payment processors are benefiting from the new laws whenever someone uses a Bank of America, Wells Fargo, or Chase debit card. Until merchants can negotiate new contracts, you will not see an opportunity for future price adjustments.

Your prediction, my friend, is way too early. Big banks got to whine about this amendment for over a year. Can we give merchants, at least, as much time to adjust?