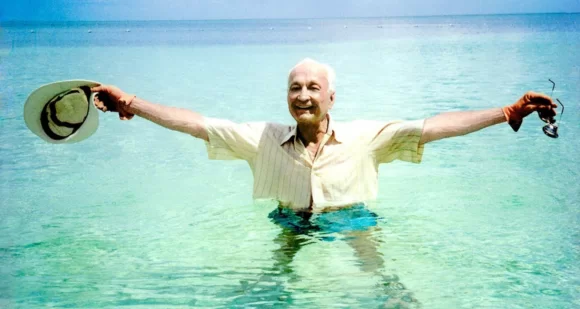

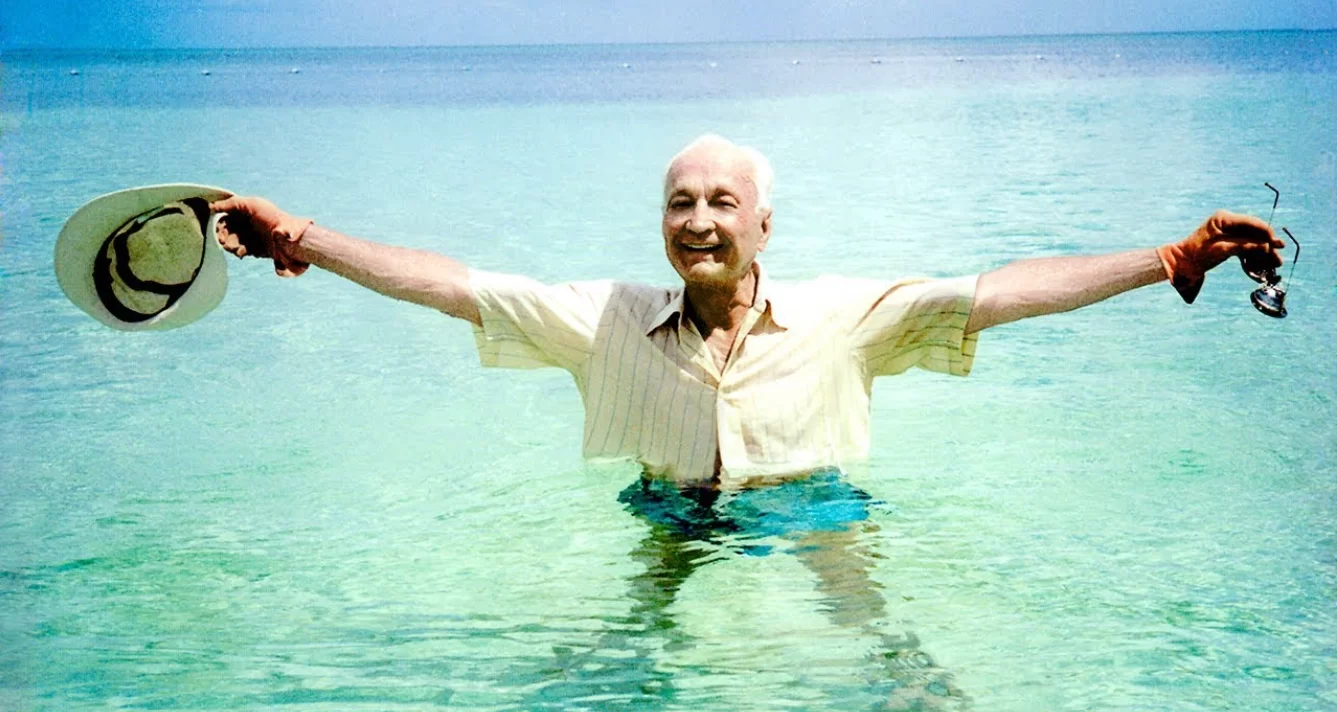

Sir John Templeton was arguably one of the greatest investing experts of the 20th century. He innovated the concepts of international and contrarian investing that most people take for granted today.

Templeton was one of the earliest advocates of value investing. When he sold his company, the Templeton Growth Fund in 1992, it was worth over $13 billion.

So, if you are a novice or experienced investor, you may want to take some cues from the life experiences of Sir John Templeton. In fact, he is famous for crafting the 16 investing rules.

1. Expect Realistic Returns Against Investments

Whenever you invest, you should have a realistic situational awareness of current market conditions, your personal tax obligations, and the inflation rate.

You shouldn’t make baseless expectations about potential returns and/or when they’ll manifest.

The general rule of thumb regarding ROI against investment is to expect at least a 7% annual return.

This is a baseless expectation. It’s a financial urban legend borne of a Warren Buffett quote that was blown out of proportion.

It was then subsequently misappropriated for financial wishful thinking.

Past market performances aren’t an accurate indicator of future metrics. There is no rule about how much average return is generated annually.

Think about inflation rates, your taxes, and market conditions to gauge potential returns without firm expectations.

2. Don’t Speculate or Trade – Invest

Investing isn’t gambling. It can take years to see a return on your investments, if at all.

You should only invest after thorough financial research and personal considerations.

Don’t invest based on hype, hunches, or a desire to prove your financial prowess in turning a quick profit.

Gamblers posing as investors can’t stop gambling. Especially when they win.

And, gamblers only admit they’ve lost big when they’re being dragged out of the proverbial casino – which they’ve purposely confused with the stock market.

3. Be Open-Minded About Investment Opportunities

You should always be flexible about which investment method works for you. It could be stocks, securities, debt, bonds, futures, and so on.

Always diversify your portfolio and choose investment vehicles that suit your custom needs.

4. Always Buy Low

If you’re obsessed with ROI potential, then you have no business buying an investment vehicle at hyped up or inflated prices.

The only way you can manage a healthy ROI is to buy as low as possible at strategic moments.

5. Research High-End Stocks With Bargain Buying Potential

You don’t have to just only buy into little-known stocks or companies ignored by market investors.

Research well-known and brand-name stocks but always look for bargain buys.

6. Be a Value Investor – Don’t Buy Based on Fads, Trends, or, “Hot Picks”

What investment opportunities are unnoticed and unappreciated by the rest of the market?

Do you think such opportunities have future value potential?

Can you buy it cheaply while the rest of the market is chasing the next hot, and expensive, stock pick?

7. Diversify, Diversify, Diversify

If you heavily invest in one company or stock, you could incur catastrophic financial losses.

Always diversify your financial portfolio according to your investing interests.

Also, a well-researched and diverse financial portfolio can lead you to new investment opportunities.

8. Research Your Investments and/or Consult Experts

The average financial advisor could charge a flat fee of $2,500 or hundreds of dollars an hour for their services.

Some financial advisors charge a 1% annual commission, or even a little more, commensurate to the portfolio value of the client.

For example, if your portfolio is worth $2 million, then your financial advisor would charge you $20,000 annually to manage it.

Pricey? Sure. However, unless you’re knowledgeable about financial investing, or want to trust an autonomous, online robo-advisor financial algorithm, you’d do well to get expert help.

9. Always Stay Apprised of Your Investment Performances

Never get in the habit of forgetting what stocks you own. Or, neglecting to constantly monitor their market performances.

The stock market never stands still and is always in a state of constant flux.

If you don’t know how your stocks are doing, or if you don’t even remember the stocks you own, then you might be losing money.

10. Panic Isn’t an Option

Panic selling is not a prudent financial strategy. Selling based on panic and overreaction will only get you into trouble that will be very hard to get out of later on.

Panic selling is nonsensical because:

- What goes down eventually goes up

- You’ll probably buy high and then sell low after calming down

- You’ll miss solid opportunities to profit

- Stock market corrections are a part of life

- Panic investing locks in and/or worsens potential losses

You’ll always invest wisely if you research, consult experts, keep realistically apprised of market conditions, and always buy low.

11. You’ll Make Mistakes – Not Learning From Them Will Be Extremely Costly

The definition of insanity is doing the same thing over and over and expecting different results.

As the old song says, everybody plays the fool on the stage of life with no exceptions.

Just don’t make repeat performances.

Analyze and learn from your mistakes. The knowledge you glean could turn into future money-making opportunities.

12. Meditate Before Investing

Investing is a high-stakes financial practice with a risk-reward ratio that is commensurate to your experience level and capacity for patience.

Take the time to meditate, pray, stretch out the tension with yoga poses, or do whatever it is you need to do before investing.

13. Don’t Expect to Outperform the Stock Market

Keep your market performance expectations realistic. Oftentimes, the stock market will beat your expectations, research, and hopes.

It happens to the largest corporate hedge funds – don’t take it too hard when it happens to you.

14. Stay Curious – You’ll Never Have All the Answers When it Comes to Investing

It’s usually at the exact moment that you decide you have everything figured out that you can shockingly realize that you don’t know much.

Never be too overconfident. Stay curious. There is always something new to learn when it comes to investing.

15. There No Such Thing as a Free Lunch

Your investing decisions will always incur positive or negative consequences.

Never invest based on sentimental ideals, to save money on a commission, to prove a point, and so on.

16. Stay Optimistic

There is a great quote about fear that you should always remember when investing: a life that is lived in fear is a life that is half-lived.

Never invest on impulse or fear. Never let fear keep you from investing. Trust your research.

Consult an Expert

Always remember rule #8 when it comes to Sir John Templeton’s 16 rules of investing. You’ll never regret having the counsel of an expert when it comes to investing.

Read More

How Much Interest Can you Make On 1 Million Dollars?

Can You Live Off the Interest On 1 Million Dollars?

How To Become a Prodigious Accumulator of Wealth

Here Are The Top Trading Laptops

A Comprehensive Ark7 Review: Is It Worth Your Time?

Want Some Investing Ideas? Check Out The Dividend Aristocrats

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.