As many of you know I got engaged last year and will be getting married next May. There is a lot of planning, talking with vendors, signing contracts, and of course spending money when you are planning a wedding. There’s also a lot of dieting, exercising, and getting in shape for engagement photos, trying on dresses (Tag, not me), and looking great for your wedding.

Obviously my goal is to save up enough money to pay for the wedding without going into debt, while also eating healthy and exercising so I look good for my future wife. However, what if I could only pick one?

What if I had two choices?

Option 1: incur unplanned expenses that make me have to borrow money to pay for the wedding but I look like a GQ model.

Option 2: Pay for the whole wedding with money I’ve saved and continue to be debt free next June, but put on 20 pounds and be overweight.

I’ll Take Health over Money Any Day

It’s really not even a question for me. I would much rather look and feel great on my wedding, and then pay off the debt over time, than be overweight for it.

Wedding pictures are forever. My honeymoon (if we can afford one) only happens once. This is the one day of my life where all my closest friends and family are there to see me, and I’ll be damned if I’m gonna look like a slob.

If I go into debt for this wedding, then I’ll pay it back. I’ll take a second job if I have to. I’ll sell my house and move into a smaller one. I’ll figure it out.

Debt can be fixed. Wedding pictures cannot.

And even if I didn’t have the wedding coming up, I would still value my health over money. I love that I can live an active lifestyle. I love that I can look in a mirror and feel good about myself. I love that my doctor doesn’t have to give me a hard time when I go get my annual physical.

Have you ever heard anyone say, “At least you’ve got your health.”? I think it’s a great saying, because no matter what situation you are in, you have time to make it better if you’re healthy enough to stick around for a while and find a solution!

Debt can be paid off. Heck, you can even rebound from bankruptcy. But if you mess up your health bad enough, you might not have a chance to fix it.

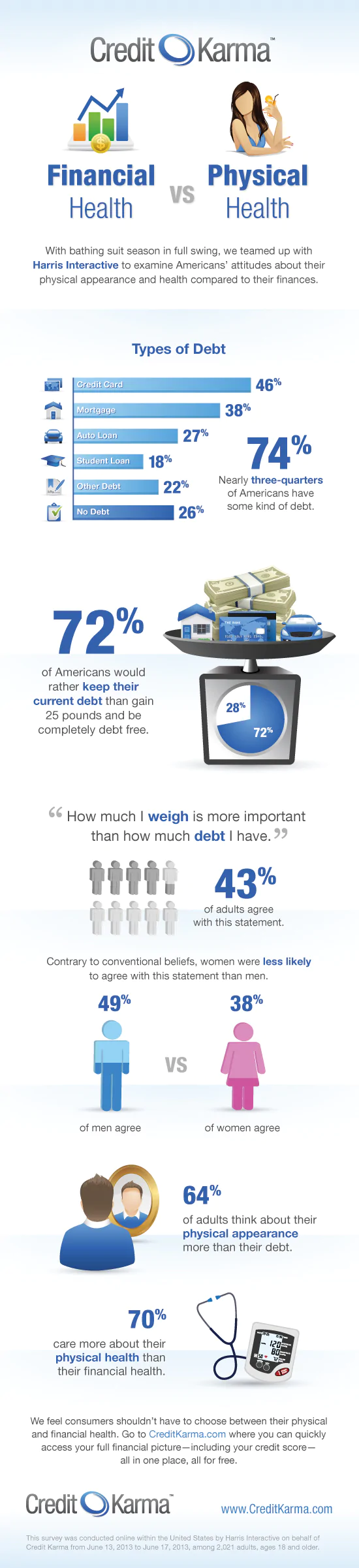

This post was inspired by a survey just released by Credit Karma. There is some interesting information about how people feel about their weight and their money. Check out the infographic below if you are interested.

Readers: What is more important to you: a small waist or a big wallet?

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Okay, let’s be real. Gaining 20 lbs? You’re not choosing “health” over money, you’re choosing vanity over money. Which is fine, but just be honest.

Neat infographic, and I love that “contrary to conventional beliefs,” more women value financial health… I actually have a sneaking suspicion that “contrary to conventional beliefs,” women are more commonly the best money managers in your household 😉

That being said, IF the 25 lb weight gain wasn’t permanent (say I could lose it ina year w/diet and exercise and be back to my normal weight & lifestyle), I would take that and lose my $50,000 debt in a heartbeat. But then again, I am currently at a healthy weight and a completely unhealthy amount of student loan debt… I bet the answer to that question depends more on your current financial and weight situation than anything else 🙂

You are right. I was thinking about using the word vanity in my post, but I didn’t. I probably should have. However, I’m right on the upper edge of a healthy weight, so if I gained 20 pounds I would definitely be unhealthy. It wouldn’t probably affect me in the short term, but if I didn’t lose the weight it could cause health issues down the road.

And again, it definitely depends on the amount of debt we are talking about. My wedding will be at most $20k, which is already 40% of your $50,000.

Good luck paying down that debt!

I don’t think it is an either or question. Your waistline is similar to your finances. You need a lot of the same skills to handle your finances and waistline.

I’m definitely striving for both, and there’s a good chance I’ll make it through next May without having wedding debt and being at a healthy weight. It’s fun to play either/or, but obviously the best solution is to have everything. It just takes work!

First off, congratulations on your engagement and upcoming wedding!

I also don’t think its an either or question. Granted, with good health you’ve

got time to correct or fix other problems but I think if you can have great health and a

healthy wallet at the same time it would would be super 🙂 So, look great on your wedding

day and still not go into an inordinate amount of debt. At the end of the day, that debt might be the

cause of bad health when you realize just what $hit-hole you’ve dug yourself into and stress sets in!

I’m with Rachel. If the 20 pounds wasn’t permanent… Ok nevermind, I’ll be honest. Even if the 20 pounds WAS permanent, I’d still choose the debt free path! If it was 50 pounds, I’d probably change my tune.

I agree with Rachel (and Keren). The first thing my kids notice when they look at our pictures is how young we looked. The second thing is how much hair we had (it was the 80s). The third is how thin we were. My guess is that any weight you gain in the new few months in preparation for the wedding will probably be regained in the first year of marriage anyway. As a lifelong dieter, I don’t like looking back on big events and remembering how hard I dieted and exercised to look like that for one day. I’d rather remember the joy and love and excitement.

What’s interesting to take into account is that studies have shown that attractive people are much more likely to get promotions, make positive networking contacts, and get better deals on things. Would it be worth the probability that by looking like a GQ model and initially be saddled with debt, you might actually end up ahead sooner?

All they need to do is to enroll with their name,

email, contact number and country and vemmabuilder will cater to the particular country of the

person. There are many web designers who charge huge amount of money

to do this job for you. Net’s builder has been out for a little more than a year, yet it already helped more than 5,000 webmasters to create their online forms.

Those that cannot apply for this kind of card or that would prefer a different solution

could consider a prepaid card that comes with a credit building element as an alternative.

Rather, they’re designed to help spark possibilities in your own mind. Html form builder renders efficient service to online business companies to create any sort of online form to integrate it into their website and receive incoming information from online visitors.