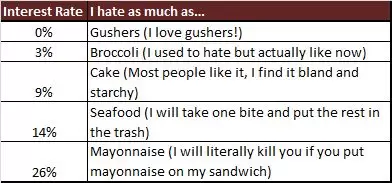

I hate paying interest on debt (unless it’s Good Debt). The higher the interest, the more I hate it. Here’s a comparison of how much I hate certain APRs and certain foods.

If you have high interest debt and want to stop paying so much interest on your loans, you can likely reduce your interest and save money. All you need is good enough credit to get approved for a good balance transfer credit card.

Step 1: Apply for and get a good balance transfer credit card

You can find some good balance transfer cards here. These things can give you 0% APR for up to 24 months, with the typical time period being 12 months. Remember, this will only work if you have good credit. Otherwise, you probably won’t be approved for the card, and if you are, the credit limit won’t be very high. You can get your credit score free at Credit Karma (not an affiliate link; I love this site!) and

Step 2: Transfer the balance from your high interest card to the balance transfer card

You should have a 0% APR, but you are going to have to pay a balance transfer fee. Let’s take the example of the Discover More Card. You can get 0% for 24 months, but have to pay a 5% balance transfer fee. That means you’ll only pay 5% in interest over two years, or 2.5% a year on the original balance.

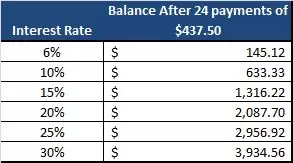

For example, say you owe $10,000. If you transfer that balance to the discover card, you’ll end up with $10,500 on the new card (because of the transfer fee). You can pay 24 payments of $437.50 and have the entire balance paid off in two years. Let’s compare this to making 24 payments of $437.50 on your original credit card, using this nifty Bankrate Calculator.

As you can see, a balance transfer can save you thousands of dollars if your interest rate is very high. Even if you don’t pay the whole card off by the end of 24 months, you will still have saved money in this scenario.

However, it’s important to know this wont always be the case! If you transferred the balance. You’ll have to use that calculator to predict your own situation and see if it makes sense. Plus there’s one other important step you must take to ensure you’re saving money.

Step 3: Make sure you always make at least the minimum payment on time.

Step 3: Make sure you always make at least the minimum payment on time.

This is the most important part. If you are a day late or a dollar short on any payment, your promotional APR will get jacked up higher than the federal deficit. You don’t want to pay 5% to transfer a balance and then be late on your first payment; they will take that interest rate right back up to around where it was before, and you’re out 5%.

Step 4: If you still have a significant balance at the end of the promotional period, consider another balance transfer.

If you can’t get the whole card paid off by the end of the promotional period, don’t worry. You still saved money in interest over the go back to step one and start over. If still have good credit and can get another balance transfer, it might make sense to do another one.

That’s it! This is a great way to save yourself money on large balances of high interest debt than eliminating interest for one to two years, and to feel better about your debt as you’re paying it off.

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

I would be very careful about using step 4. It is important to note that even though you may not be paying 24% interest with the balance transfer, you are still paying interest (in the form of the balance transfer fee). Step 3.5 should be to create a budget and a schedule to plan how you will pay off the loan

People should not look at balance transfers as a never ending source of free money, instead they should look at this as a powerful tool to become debt free.