Those who don’t win the lottery are probably the luckiest ones. Nothing that is worthwhile in life is ever earned without sacrifice and struggle. And it should be noted that when something is given to you, and not earned the hard way, it can be easily taken away. We all dream about winning the lottery, but not many consider the taxation and emotional perils that come with it. And we may be getting too philosophical to worry about such matters anyway. Your odds of winning the lottery are astronomical anyway. You have better odds of being hit by a dinosaur wearing sunglasses and riding an asteroid before winning the lottery. Still, lottery winners do exist. So, if you ever do win the lottery, you are much better off taking the lump sum lottery winnings.

If you win the lottery and opt for annual payments, you are just asking for progressively worsening future headaches. If you choose annual payments, you are opting for decades of tax payments and numerous legal logistical nightmares.

If you ever find yourself the winner of a large lottery, opt for the lump sum lottery winnings. Don’t opt for the annual payout or so-called annuity lottery payments.

Before we get into the reasons why it’s better to take the lump sum lottery winnings, let’s first address the glaring reality; your odds of winning a jackpot lottery are slim to impossible.

Lump-Sum Lottery Winnings (The Reality)

I don’t want to rain on your parade, but here comes a thunderstorm of facts.

You probably will never have to worry about stressing over whether to take the lump sum lottery winnings in your lifetime.

That is because you will probably never win a large-scale lottery.

Your odds of winning a Mega Millions jackpot is 1 in 302.6 million. And your odds of winning a Powerball jackpot is 1 in 292 million.

You have a 1 in 3.75 million chance of being devoured by a great white shark “Jaws,” style. In other words, you are 80 times more likely to become the main dinner course for a great white shark than win the lottery.

You have a 1 in 1.17 million odds of being struck by lightning than hitting the jackpot. You are 250 times more lighting to be struck from a bolt from the blue than win the lottery.

There is a 1 in 10,000 chance that you will slip in your bathroom and horribly injure yourself before you win a jackpot. You are 30,000 times more likely to have an injurious slip-and-fall in your bathroom before winning the lottery.

Watch your head! You have a 1 in 10 million chance of being hit by falling airplane debris before winning a jackpot lottery.

Your odds of winning a billion dollars by winning both a Mega and Powerball jackpot simultaneously are incalculable. The odds of winning both jackpots simultaneously are about 1 in 88 quadrillions.

A quadrillion is a number that is followed by 15 zeros.

Anyway, you get the picture. You are probably not going to win a jackpot lottery in your lifetime.

However, let’s say that you do. Why should you opt for lump sum lottery winnings?

Lottery Taxes

Would you rather pay one big tax bill or a series of annual tax bills over the next 20 or 30 years?

There are two big winners when you win a jackpot lottery, you and the taxman. Lottery winnings are considered a form of taxable income.

After you win the lottery, the federal government and the IRS will automatically take a slice before you receive one penny.

Depending on where you live and your tax bracket, you could pay anywhere between 25% and 37% in federal taxes before you receive your prize.

And those are just the federal taxes you will pay on lottery winnings, You still must pay state, city, and local taxes on your lottery winnings as well.

If you live in these states or D.C., here is what you will pay in lottery taxes:

- New Jersey: 10.76%

- Minnesota: 9.85%

- District of Columbia: 8.95%

- New York: 8.82%

- Vermont: 8.73%

- Iowa: 8.5%

- Wisconsin: 7.65%

- Oregon: 7.6%

- Maine: 7.1%

- South Carolina: 7.0%

Go buy your lottery tickets in Tennessee. In Tennessee, the state lottery tax is only 1%.

The point here is that if you opt for the lump sum lottery winnings then you only have to pay federal, state, and local taxes once.

If you opt for the annual lottery payout over 30 years, for example, then you will pay lottery taxes every year for decades.

Also, keep in mind that you pay taxes based on tax laws and policies of the moment, not when you won the lottery. If your federal and local taxes increase every year, then you will receive a guaranteed lower payout every year.

Lottery Organizer Bankruptcy

Do you know who actually organizes the lottery? It is not easy information to find out.

There are some state entities that organize the lottery. And then there is the nefarious sounding Multi-State Lottery Association, a multi-state consortium that organizes lotteries in multiple states.

The point is that you are trusting state entities to pay your annual lottery winnings every year if you opted for such.

The entity paying out your annual winnings could go bankrupt or become unable to pay your winnings.

While improbable, this theory is not impossible and could give you a lot to think about while waiting for your annual payment.

Death is a Bummer

Here is another reason why you should take the lump sum lottery winnings – death.

You should be able to bequeath your lottery winnings to your loved ones in a will. However, the fun in winning a lottery is living to enjoy the spoils.

Imagine winning the jackpot, opting for a 30-year annual payout, and then dying of natural causes two years later.

Inflation Means Dollars In The Future Are Worth Less Than Today

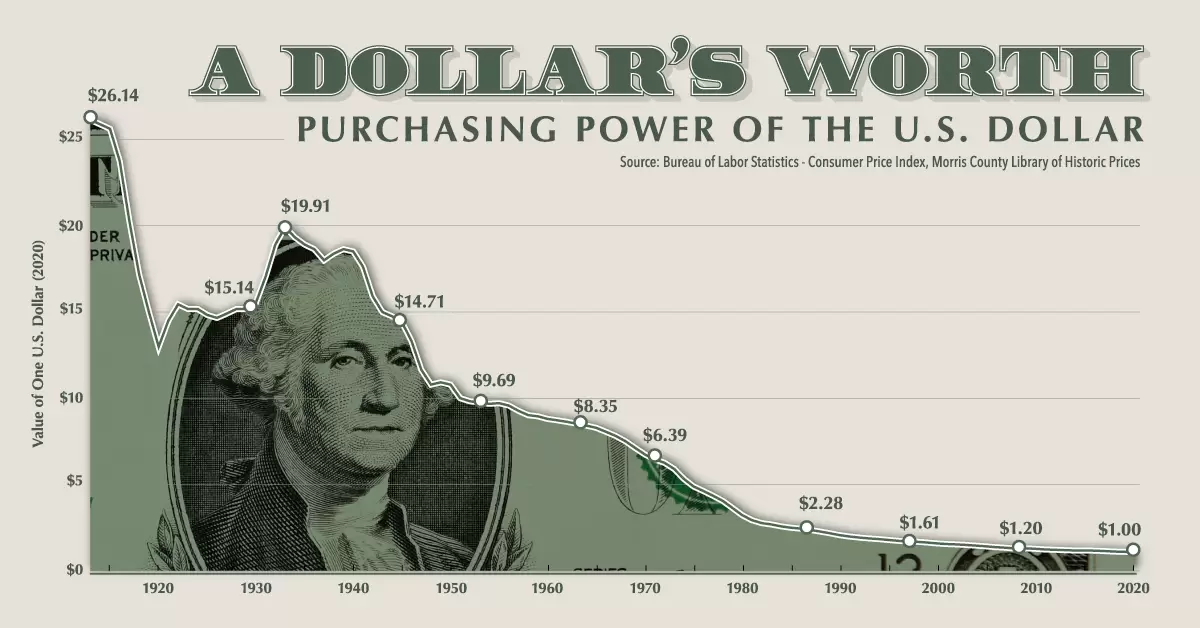

One reason to take the lump sum payout instead of the annualized payout is: tomorrows money is worth less than today’s money. Inflation is always a factor in the United States. Here is a compelling chart from visual capitalist showing the declining purchasing power of the US Dollar in the last hundred years.

Essentially this means if you take the annualized payment options, they’ll be worth less in the future, at least in terms of their purchasing power.

Personal Finance Control

It’s your prize, so why not control all of it now?

If you opt for the lump sum lottery winnings, then you get to control all of the money you won.

With the annual payout, you will only control a fraction of your fortune each year. And if your tax obligations increase each year, you will progressively have less money to control.

Lump-Sum Lottery Winnings

I think you are better off saving your money, paying off your debts, and investing wisely instead of buying lottery tickets.

However, if you do ever hit the jackpot, go for the lump sum lottery winnings.

And in the meantime, watch out for falling airplane debris.

Read More

How to Trade a Car You Still Owe Money On

3 Ways to Make Money on Facebook

How Do You Attract Money and Abundance?

Here Are The Best Laptops For Trading Stock

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.