Editor’s Pick

Stocks

Stocks

How to Become a Millionaire From Investing in Stocks?

Investing in stocks can be a powerful way to build wealth and achieve financial independence. With the right strategies and ...

Vanessa Bermudez

July 26, 2024

Personal Finance Tips

Motley Fool Stock Picks: This Is How to Beat the Market

When you pick a stock, the intent is usually to outperform the market. However, most investors aren’t successful. So, what ...

Tamila McDonald

September 13, 2023

General Personal Finance

These Are The Best Laptops for Trading Stocks 2018

The current, burgeoning bear market is making a lot of investors anxious. However, knowing how to read the market and ...

Allen Francis

September 1, 2023

Stay Connected

We’re grateful! Thanks to these companies for helping keep the lights on:

Earn College Credits Online at Excel

Technology

I Have The Perfect Punishment for Wanetta Gibson

Kevin McKee

January 24, 2024

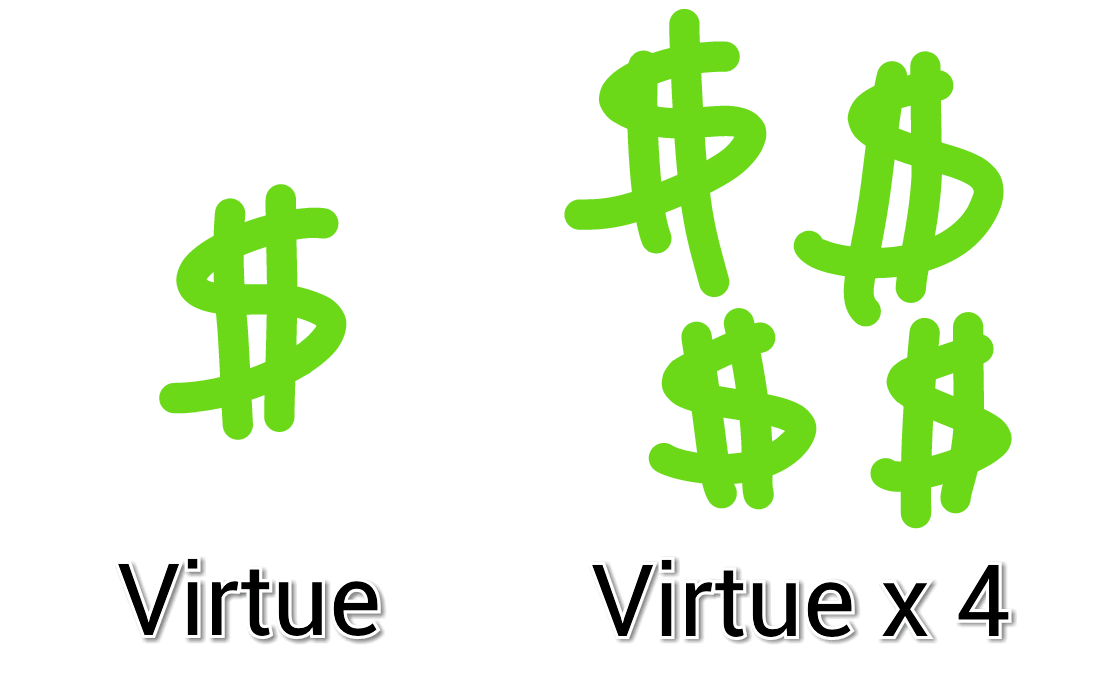

To Make Money Honestly is the Highest of Virtues

Kevin McKee

November 11, 2023

How to Make Money Without a Degree

Kevin McKee

June 4, 2023

Life

What Are the Levels of Wealth?

Money is a tool. You must always remember that rule if you want to achieve financial independence. And to achieve financial independence, you must climb the levels …

How To Become a Prodigious Accumulator of Wealth

September 2, 2024

What Are the Different Types of Wealth?

August 27, 2024

Small Business

10 Brutal Truths About Dropshipping That No Guru Will Admit

Everyone wants to sell you on the dream that a dropshipping business changed their life. Gurus will try to sell you on courses and subscriptions to help you …

Top 7 Small Town Business Ideas That Can Make You Rich

October 26, 2024

How Many Hours Do Millionaires Work?

August 28, 2024